Major Japanese political events are now behind us

Turning first to politics, it has been a turbulent closing few months of 2024 for Japan’s Prime Minister Shigeru Ishiba. After taking office in October, Ishiba called for a snap parliamentary election, which his ruling Liberal Democratic Party (LDP) lost. In mid-November, Ishiba won a run-off vote to stay in power. He failed to win a clear majority but pulled significantly ahead of his main challenger, Yoshihiko Noda, the leader of the main opposition Constitutional Democratic Party. While the minority government looks fragile, the vote should buy Ishiba some time, and we expect political uncertainty to receive less attention in 2025.

One of Ishiba’s first priorities will be to meet US president-elect Donald Trump, who won a decisive election victory in November. Given that Trump and the Republican Party secured a “red sweep” of all three branches of government, the Trump administration is in a position to quickly reverse course on many of the policies implemented by Democrats during Joe Biden’s term in office. This could play a significant role in ending the wars in Ukraine and the Middle East. It could also mean a potential start to a programme of mass deportation of illegal immigrants within Trump’s first 100 days as president.

Another area of Trump’s policies attracting attention in the rest of the world is his promise of “Trup Tariffs”—proposals to invoke tariffs of between 60% and 100% on Chinese goods, and a tax of between 10% and 20% on every product imported from all US trading partners, Japan included1 . However, even if Trump does embark on protectionist trade measures against the rest of the world, Japan could be better positioned relative to other countries given the importance the US places on Japan as one of its most important allies. Moreover, considering that a global trade war would likely be focused most heavily on China, Japan will also arguably benefit by gaining market share at China’s expense.

Domestic policy expected to remain in right direction

On many occasions, both before and after being named prime minister, Ishiba indicated his administration would continue with the policies laid out by his predecessor, Fumio Kishida. The economy will clearly be Ishiba’s top priority with a focus on the following factors:

- Prioritising Japan’s exit from a deflationary environment

- Ensuring Japan has a growth-oriented economy driven by wage hikes and investments

- Promoting innovation to improve productivity and drive personal consumption spending

- Further develop Japan’s plan for “Promoting Japan as a Leading Asset Management Center”, which includes the new NISA (Nippon Individual Savings Account) programme (expanded tax-exempt investment savings) to encourage individuals to shift from savings to investments

Japan’s Corporate Governance reform agenda will also be intact, encouraging further investor disclosure and creating pressure on companies to improve profitability and to drive growth, which we believe will certainly drive further interest in Japanese equities.

One important aspect of domestic policy to keep in mind is that given Ishiba’s fragile minority government, he will need to seek support from the opposition parties, including the Democratic Party for the People, which gained momentum in the October election, and the Japan Innovation Party. As a result, his administration will likely have to incorporate some elements of these parties’ policy ideas into government policies, which will have implications for certain segments of the market.

Personal consumption to increase

One such area is personal consumption as the opposition parties are calling for tax cuts and other subsidies to help boost disposable household income given that Japan is experiencing inflation for the first time in several decades. There are other factors that are also expected to positively impact personal consumption.

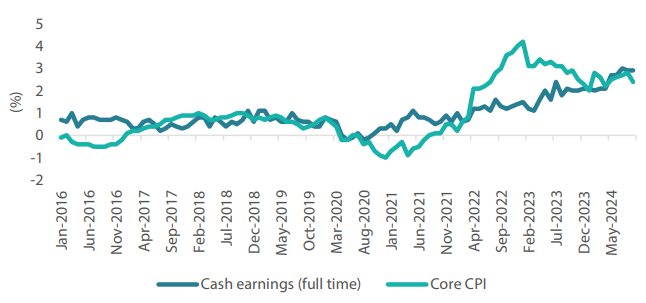

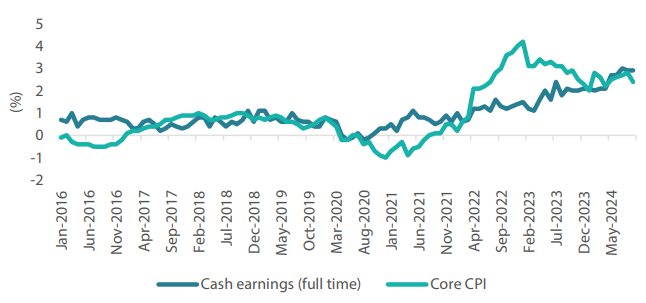

Chart 1: Cash earnings* vs. core Consumer Price Index (CPI) (year-on-year)

*Cash earnings are based on the monthly labour survey (same sample basis) conducted by the Ministry of Health, Labour and Welfare

Source: Ministry of Internal Affairs and Communications, Ministry of Health, Labour and Welfare, 30 September 2024

Upward trend in wages seen continuing

Rengo, Japan’s largest labour union federation, recently announced its target wage hike of “5% or more” for 2025, maintaining the same level as 20242 . Rengo’s announcement indicates that healthy wage growth is likely to continue. Moreover, Rengo raised its target wage hike to 6% for small and medium-sized enterprises (SMEs) to close the gap with large corporations3 . This is particularly important as approximately 70% of Japan’s employee population work for SMEs4 . In addition, it was reported that UA Zensen, another large union group with about 1.9 million members across sectors including retail and restaurants, would maintain an even higher wage hike target of 6% overall and 7% for part-time workers5 .

Real income growth recently turned positive on the back of continuing wage growth. We expect this extended increase in wages to have a positive impact on consumption and companies in the consumer discretionary sector. Construction is another sector for investors to focus on, as Japan’s key political parties are aligned in terms of strengthening disaster prevention measures.

In general, we expect the new administration’s policies to boost the economy (and concurrently the government’s approval rating) ahead of the Upper House election in July 2025. However, if the government’s approval rating declines and the LDP loses seats in the Upper House election, the party may look to replace Ishiba soon after the election. Even in that case, we believe the key policies will remain intact under a new LDP leadership, with investors taking a change in the administration in stride.

* Forecast is not necessarily indicative of future performance.

Monetary policy expected to keep normalising

On the monetary policy front, the Bank of Japan (BOJ) is expected to continue raising interest rates gradually over time. Such a stance would underscore the BOJ’s confidence in achieving a virtuous cycle of wage increases and price hikes going forward. In its Outlook for Economic Activity and Prices report6 the BOJ said: “Nominal wages are expected to keep increasing clearly, partly reflecting price rises, and employee income is projected to continue increasing. Against this backdrop, for the time being, although private consumption is expected to be affected by the price rises, it is projected to continue increasing moderately, mainly reflecting the rise in wage growth”.

Considering that the relatively high volatility of the Japanese yen recently was driven by external factors, further rate hikes are likely to be increasingly influenced by currency movements. The BOJ appears ready to hike rates when the yen weakens as the currency’s depreciation can raise import prices, translating into higher price levels.

Japan’s real interest rate still remains negative and the BOJ is merely adjusting its policy while keeping the monetary environment accommodative. There might be some periods of equity market volatility in 2025 stemming from rate hikes and currency moves. However, we believe such bouts of market volatility will also create opportunities as some stocks may be oversold temporarily in the process.

From our perspective, the primary focus is to concentrate on companies and the measures they will be implementing to unlock and create value. In this respect, there are several reasons to believe that companies will intensify their efforts to unlock and create value in 2025.

* Forecast is not necessarily indicative of future performance.

Companies to enter next phase of TSE’s capital efficiency guidance

In March 2023, the Tokyo Stock Exchange (TSE) asked companies to focus on cost of capital and stock price actions involving the following steps:

- Analysis of the current situation

- Planning and disclosure

- Implementation of initiatives

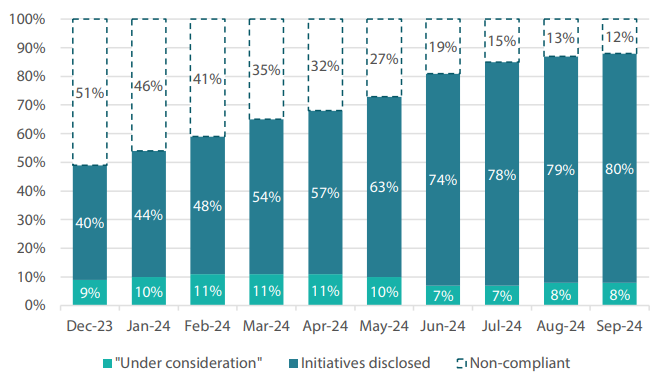

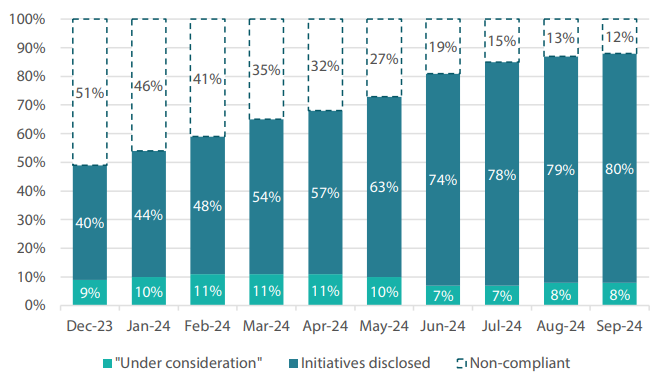

Approximately 90% of the companies listed on the TSE’s Prime Market have already responded to this request. Companies are now entering the next phase, in which they will be implementing actions to achieve the targets disclosed to date.

Chart 2: Status of compliance with TSE’s requests

Source: JPX, 31 October 2024

Shareholder activism still increasing

Activist investors in Japan are becoming a growing presence. Japanese equity market culture has been changing dramatically, enabling shareholders to be more vocal—and sometimes even hostile—towards the companies they invest in, all in the name of “shareholder engagement”.

Crucially, the lines between shareholder activism and stewardship are increasingly blurred. In recent years, there has been lower support for the re-election of board members, particularly where companies are facing issues related to capital efficiency. Moreover, certain shareholder proposals are gaining more support from other shareholders, including institutions.

The implications of this dynamic have become increasingly clear for all parties. When activist investors choose to champion issues considered to be in the collective interest of all shareholders, they can now expect to gain support from institutional investors that share the same concerns and are also required by the Stewardship Code to act in the best interests of their clients. In other words, activists now have the increased leverage required to make things happen.

The trend is continuing to accelerate. In August 2024, the Financial Services Agency introduced Active Ownership Principles. These establish the common principles required by asset owners to fulfil their fiduciary duties, and stewardship activity is highlighted as one of the key principles.

As a result, we expect to see an increase in corporate initiatives to achieve higher capital efficiency. We believe that these will be driven by both the TSE’s guidance and the pressure exerted on the companies by shareholders as part of their stewardship activities. The corporate initiatives are likely to include a continued rise in shareholder distributions (dividends and buybacks), as well as an increase in merger and acquisition (M&A) activities, which are expected to unlock and/or create value.

Private equity activity also accelerating

Against this backdrop, it is also encouraging to see that long-term capital is identifying new opportunities. Here are some notable examples of private equity activity (source: Nikkei, 11 June 2024 and 22 May 2024):

- Blackstone announced plans for deals in Japan amounting to Japanese yen (JPY) 1.5 trillion (USD 9.6 billion through to 2027, an amount on par with its total investments in Japan since 2007.

- Bain Capital plans to invest more than JPY 5 trillion in the next five years (through to FY 2029), roughly doubling its investments in Japan over the past five years.

- In May 2024, Carlyle Group wrapped up fundraising for a new Japan-focused fund. With JPY 430 billion in capital, this fund is roughly 70% larger than Carlyle’s previous Japan-focused fund formed in 2020.

Ample cash on balance sheets to give companies range of strategic options

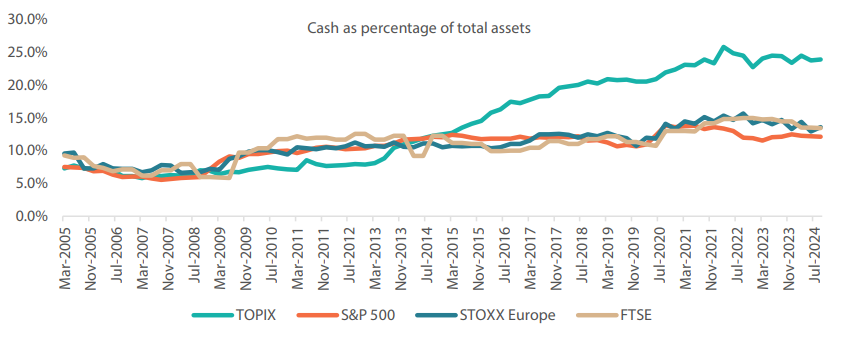

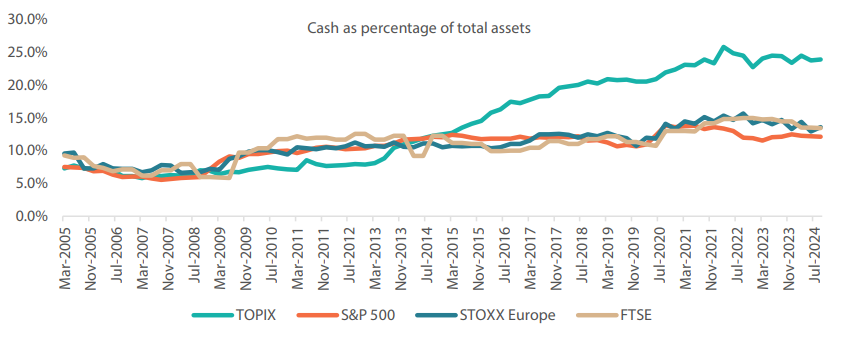

Japan continues to boast a significant number of net-cash companies. In fact, more than half of the companies listed on the TOPIX index (excluding financials) have positive net-cash positions. Moreover, cash holdings provide downside protection while allowing investors to participate on the upside if the cash is put to effective use. Chart 3 below shows how Japanese companies are cash-rich relative to other markets.

Chart 3: Japanese companies are cash-rich relative to peers in other markets

Source: Bloomberg, 30 September 2024

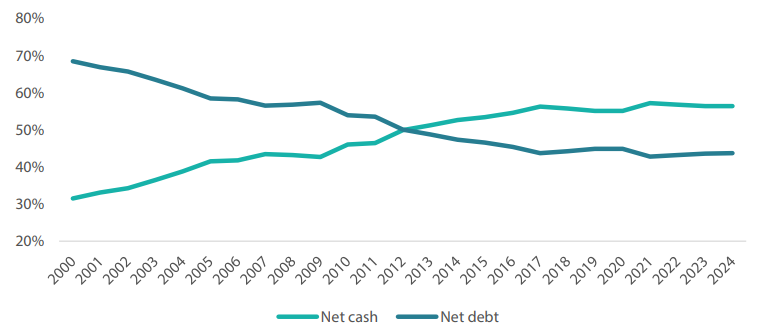

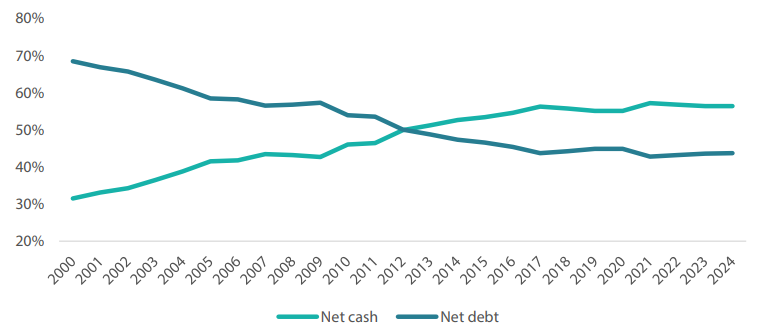

Hoarding large sums of balance sheet cash used to be the preferred option for corporate Japan, but the inflationary environment means cash is no longer king (Charts 4 and 5). Companies are also becoming increasingly conscious of their cost of capital and recognise that hoarding cash means destroying long-term value. As a result, companies are likely to pay out more cash in the form of dividends and buybacks as a simple way to keep shareholders happy. Companies could also use their cash for capital expenditure to create value.

Chart 4: Percentage of net cash, net debt held by Japanese companies

Source: Nikko AM based on Bloomberg data as at June 2024

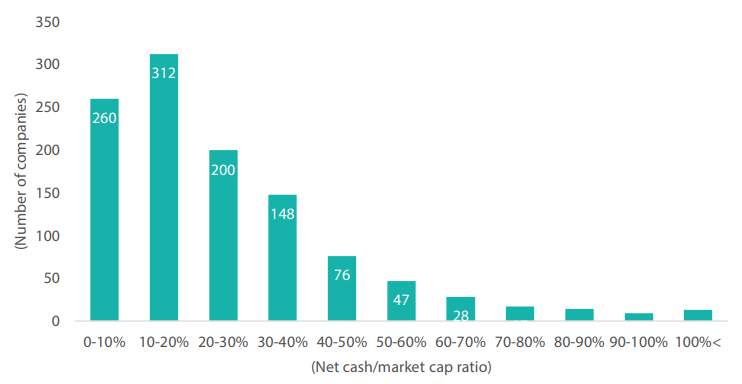

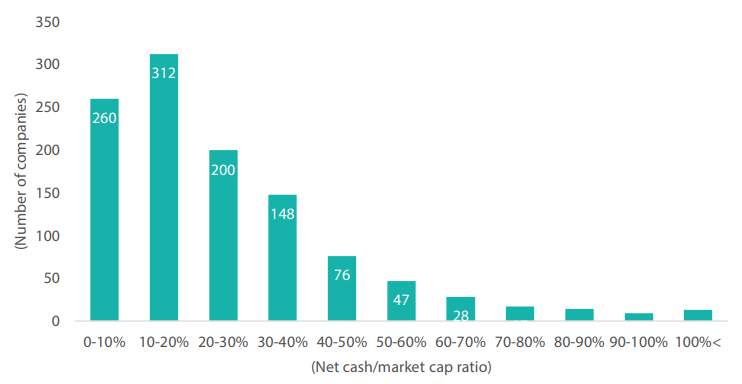

Chart 5: Distribution according to companies’ net cash/market capitalisation (cap) ratio7

Source: Nikko AM based on Bloomberg data as at June 2024

In view of the above, cash-rich companies with excess savings are the “low hanging fruit” for the growing number of activist investors. Companies with real estate holdings with unrealised gains will also likely continue to be targeted by activists.

Japanese companies are still attractively valued

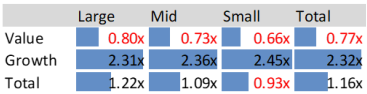

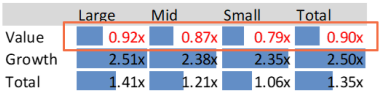

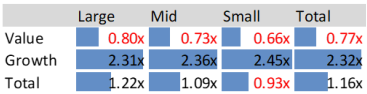

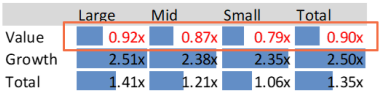

Finally, it is evident that Japanese companies—in particular value stocks plus small-cap8 and mid-cap9 names—still appear cheaply valued, even after the market rally over the last two years. Table 1 below shows the price-to-book (P/B) ratios10 of Japanese value and growth stocks, comparing where valuations stood before the 2023 market rally with the latest figures as of the end of October 2024. Given that the TSE is focused on getting companies to achieve a P/B ratio of 1x, the small- and mid-cap segments of the market, which went largely unnoticed during the market rally, still look very attractive in our view.

Table 1: P/B ratios of Japanese value and growth stocks between December 2022 and October 2024

end-Dec 2022

end-Oct 2024

Source: Russell/Nomura Japan Indexes, Nomura Fiduciary Research & Consulting, 31 October 2024

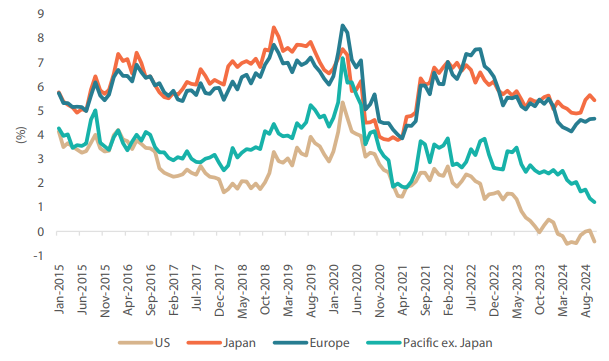

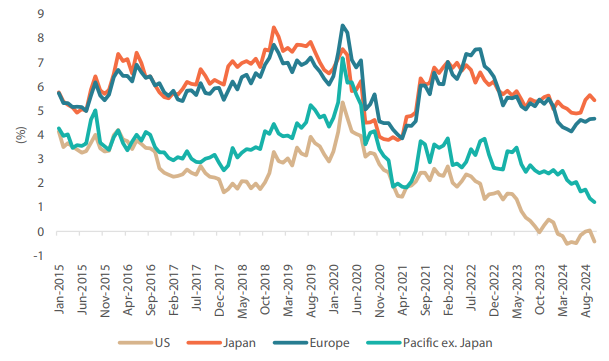

Chart 6: Spread between earnings yields and bond yields by market

US: Earnings yield (S&P 500) – US 10-year yield

Japan: Earnings yield (TOPIX) – Japan 10-year yield

Europe: Earnings yield (MSCI Euro Index) – Germany 10-year yield

Pacific ex. Japan: Earnings yield (MSCI Pacific ex. Japan Index) – Australia 10-year yield

Source: Nikko AM, based on Bloomberg data as at end-October 2024

Conclusion

We expect 2025 will be the year when Japanese companies effectively follow through with the actions that the TSE has asked them to implement, and we feel that the enactment of such measures will bode well for Japanese equity markets. Although Japan could experience a change in political leadership in 2025, it may not have a big impact on the markets as any incoming administration is expected to maintain the existing political agenda. We are likely to see periods of uncertainty. However, these periods will also create opportunities, particularly for those investors who recognise value in a Japanese market which is currently priced attractively relative to its peers (Chart 6).

* Forecast is not necessarily indicative of future performance.