Domestic demand in Asia resilient on the back of gradual monetary easing1

Asia ex-China demonstrated resilience in 2024, with growth buoyed by strong local demand and healthy exports. Easing inflation—driven by relatively tight monetary policies2 and moderating food and commodity prices—allowed most Asian central banks to reduce policy rates in the latter half of the year.

As we move into 2025, growth in Asia ex-China may moderate slightly but is expected to stay largely supported by firm domestic demand. We expect inflation to remain subdued as regional food prices stabilise. Now that inflation is within central banks’ targets across most Asian economies, the path is clear for further monetary easing to mitigate potential downside risks. Nonetheless, central banks are likely to implement interest rate cuts gradually while closely monitoring economic and monetary cues from the US.

Meanwhile, US-China tensions have been reshaping global supply chains as multinational firms adopt “China plus one”3 strategies to mitigate the impact of tariffs and reduce dependence on Chinese manufacturing. This shift is expected to continue after Donald Trump becomes US president, thereby bolstering foreign direct investment (FDI) into the region and supporting overall growth.

Asia’s sound fundamentals: fiscal consolidation and overall stable current account balances

As Asian economies recover from the COVID-19 pandemic, fiscal policies across Asia ex-China have shifted towards consolidation. Countries including India, Malaysia and the Philippines have reaffirmed their commitment to fiscal prudence over the medium term. While new leadership in Indonesia and Thailand could introduce some short-term uncertainty, we expect both countries to maintain a manageable fiscal stance overall.

Healthy export growth has supported current account surpluses in high-income, technology-exporting economies such as South Korea, Malaysia and Singapore in recent years. Looking ahead, these surpluses may moderate if global trade slows in response to the likelihood of increased US tariffs. Meanwhile, Thailand’s tourism recovery is expected to help the country maintain its current account position. In contrast, India’s current account deficit is likely to remain stable, aided by an improving services balance. Elsewhere, rising service exports and steady remittances to the Philippines have made its current account deficit more manageable.

Asian local bonds poised to perform well in 2025

Asian local government bonds are poised to perform well in 2025 thanks to accommodative policies by central banks amid benign inflation and moderating growth. The global easing cycle is expected to lower global yields, thereby providing additional support to Asian bond markets. Furthermore, we expect growth worldwide to moderate in the medium term, as the possibility of the incoming Trump administration implementing more tariffs looms large. This scenario is likely to support bond markets overall. In addition, the impact of such uncertainties on Asian currencies should be tempered by the region’s strong fundamentals and the US Federal Reserve (Fed)’s easing trend. Asian bonds and currencies have also been relatively less volatile compared to other markets over the past two years, reflecting the strength of the region’s economic fundamentals.

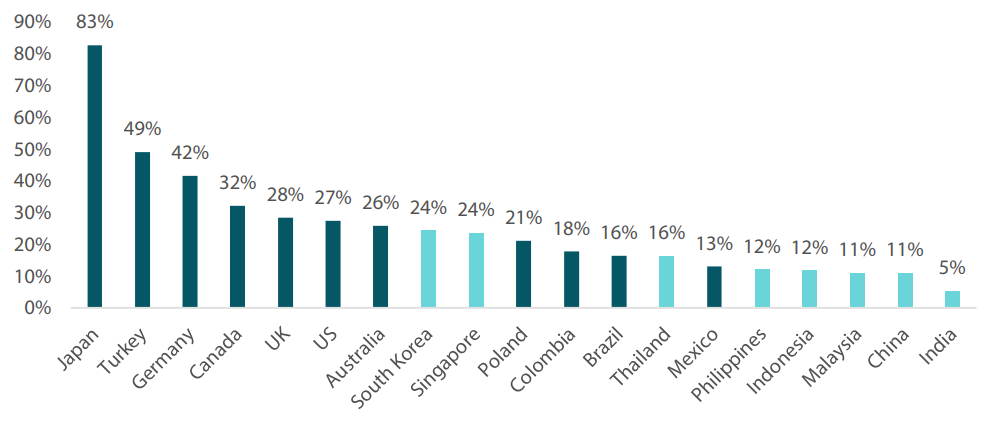

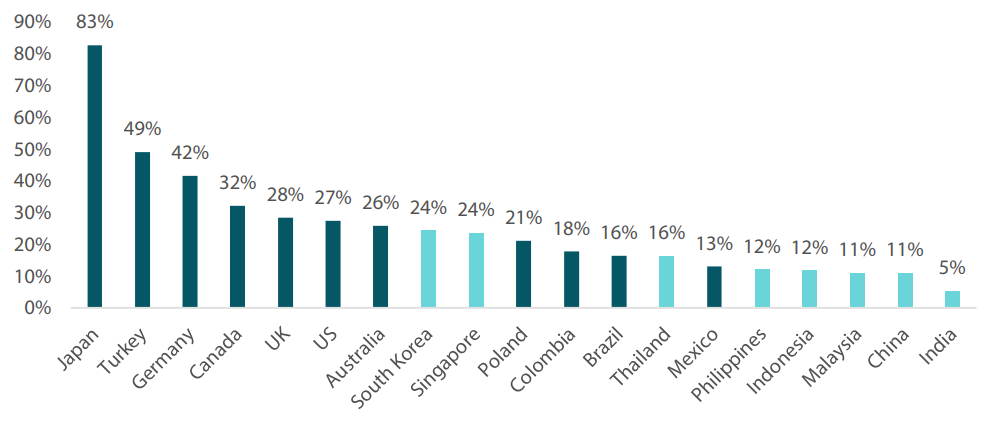

Chart 1: 10-year bond yield volatilities over the past two years

Source: Bloomberg, Nikko AM, 31 October 2024

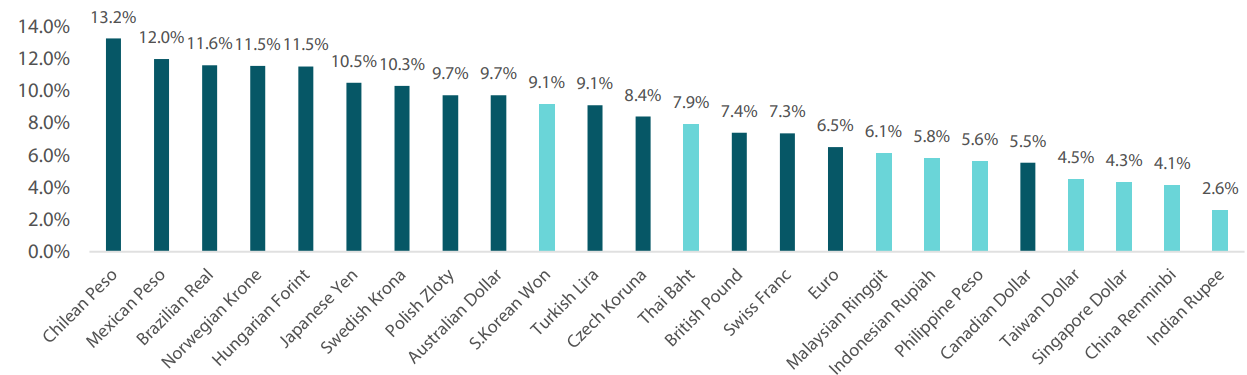

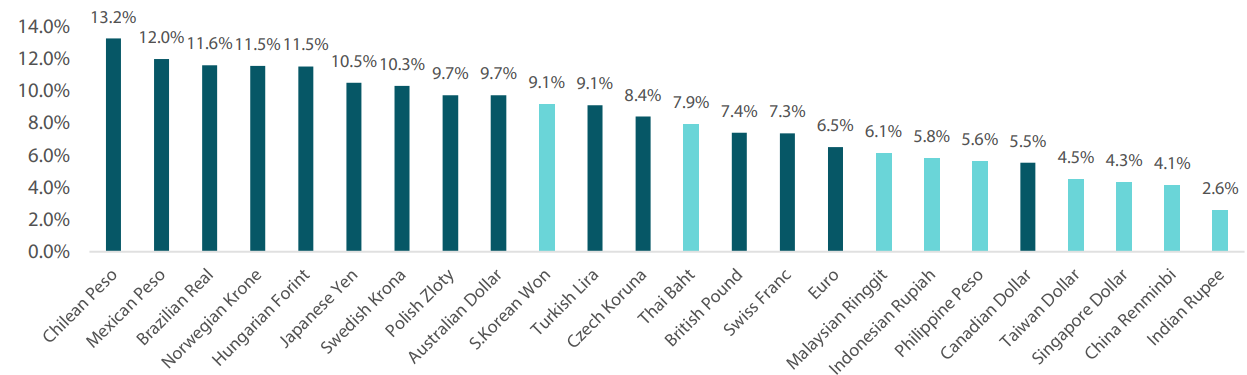

Chart 2: Currency volatilities over the past two years

Source: Bloomberg, Nikko AM, 31 October 2024

China’s policy toolbox not empty

China is set to continue with its efforts to rebalance the economy. Specifically, it will continue working to reduce its reliance on the credit-intensive property and infrastructure sectors while placing a greater emphasis on technology, sustainability and advanced manufacturing. In sectors such as electric vehicles (EV) and batteries, China has established a leading position and will continue channelling investments into these and other strategic sectors. Trump’s re-election raises the prospect of increased tariffs on Chinese goods, which could potentially hamper China’s economy. However, both Chinese officials and firms are likely to be better prepared this time.

Chinese authorities may choose to engage in negotiations with the US on trade policy to lessen the impact. They are also likely to adopt more easing policies to mitigate the effects of a challenging external environment and to stabilise overall growth. However, given structural issues such as overcapacity in certain sectors, high debt levels and an aging population, they may take a cautious approach in their policy response, preferring incremental measures over a large stimulus package. These same structural issues could keep inflation subdued, allowing the central bank more room to remain accommodative.

While challenges to trade persist, China’s sizable trade balance should provide a buffer against swings in investment flows. Although debt levels are elevated, most of it is domestic, which lessens concerns over potential impacts on the currency. With continued policy support also factored in, we expect China’s economy to remain stable for the most part.

India and Indonesia: solid fundamentals with attractive real yields

As the Fed steps up its monetary easing, Indian and Indonesian government bonds are becoming increasingly attractive due to their high real yields. Both countries also have stable current account deficits, benign inflation and sound fiscal positions.

India’s services account is on the rise, buoyed by increasing business services, travel and software exports. This trend alleviates pressures on its current account deficit. The inclusion of Indian bonds in JP Morgan’s Government Bond Index-Emerging Markets (GBI-EM) Index should also drive sustained foreign inflows, boosting demand further. Meanwhile, the Reserve Bank of India’s recent shift to a neutral monetary stance4 hints at a potential shift towards more accommodative measures in the future. Lastly, Standard and Poor's (S&P) Global’s positive outlook on India signals the potential for a long-awaited ratings upgrade over the medium term.

In Indonesia, growth remains largely stable, helped by strength in the domestic economy. President Prabowo Subianto reinforced his commitment to policy continuity through key cabinet appointments, including the reappointment of Sri Mulyani Indrawati as finance minister. This decision underscores the president’s focus on fiscal discipline. Additionally, the new administration has affirmed its pledge to develop Indonesia’s Electric Vehicle (EV) supply chain, which is expected to be a key driver of growth ahead.

Other bright spots: the Philippines, Malaysia and South Korea

The prospect of more rate cuts by the Bangko Sentral ng Pilipinas5 creates an attractive environment for local government bonds, particularly as foreign interest in the Philippine peso (PHP) local markets grows. Additionally, the Philippines’ ongoing efforts to be included in emerging markets bond indices further enhance the appeal of its bond market.

We expect robust exports and firm domestic demand to continue supporting Malaysia’s growth. The government’s fuel rationalisation plan is expected to improve Malaysia’s fiscal health and support local bonds in turn. Additionally, the country’s local bonds are expected to show lower volatility than their regional peers thanks to steady demand from domestic investors. At the same time, pension fund investments could further reinforce Malaysia’s bond market stability by keeping long-term yields anchored.

Market expectations for further monetary easing in South Korea have been modest. However, with the domestic economy facing weakness and the potential for a global trade slowdown, the likelihood of additional cuts could rise, benefiting South Korean government bonds. Meanwhile, the potential inclusion of South Korean bonds in Financial Times Stock Exchange (FTSE’s) World Government Bond Index (WGBI) further boosts their attractiveness.

Singapore bonds

Singapore Government Securities (SGS) to outperform US Treasuries (UST)

The Monetary Authority of Singapore (MAS) forecasts that the city state’s 2025 growth will align closely with its potential, although challenges are anticipated due to risks stemming from geopolitical tensions and the uncertain pace of global policy easing. Headline inflation is expected to ease, largely due to lower accommodation costs, while core inflation is set to moderate as import costs stabilise and wage growth slows. Given these dynamics, we expect the MAS to adjust its policy to a less restrictive stance in the second half of 2025, when both growth and inflation are anticipated to ease.

Singapore Government Securities (SGSs) are expected to outperform United States Treasuries (USTs), barring a US recession. Unlike the US, which has increased its debt issuance to cover budget deficits, Singapore maintains a balanced budget policy and does not rely on government bond issuance to finance its spending. Meanwhile, the issuance of sovereign and statutory board green bonds is expected to increase as Singapore targets its 2050 net-zero goal.

SGD credit returns to be driven by lower rates and coupon carry

Looking ahead, we anticipate primary supply to remain roughly similar to 2024, with around Singapore dollar (SGD) 17 billion of bonds maturing or due for first call6. Additional supply is likely to come from opportunistic borrowers, including foreign banks, driven by cost savings from currency conversions. We expect the supply to be readily absorbed as investors shift from short-dated bills (with falling yields) to higher-yielding credit bonds.

We expect credit returns in 2025 to be driven by falling interest rates and steady coupon carry7, with credit spreads remaining tight. We are still constructive on SGD credit in view of support from strong issuer fundamentals that could limit spread widening. Robust demand from local buy-and-hold investors focused on all-in yields, coupled with Singapore’s safe haven appeal, may sustain interest in the asset class.

Along the credit curve, we prefer the BBB8 segment for its higher spread buffer and income carry. Within the high- yield sector, we are comfortable targeting subordinated corporate perpetuals and bank capital from issuers with strong fundamentals.

*Forecast is not necessarily indicative of future performance

Asian credits

Asia credit yields remain attractive; spreads likely to be rangebound, returns to be driven by carry

We expect Asia credit fundamentals to stay resilient in 2025. As highlighted above, China is expected to continue working to rebalance its economy. In addition, it is thought likely to adopt more accommodative policies to mitigate the effects of a challenging external environment due to US tariff risks and to stabilise overall growth. Asia ex-China macroeconomic fundamentals may moderate slightly from the robust levels seen in 2024 as export growth comes under pressure, but they are expected to remain resilient overall. Asian central banks have ample room to ease monetary policy to support domestic demand.

Against a benign macro backdrop, we expect Asian corporate and bank credit fundamentals to also stay resilient, aside from a few sectors and specific credits which may be affected by tariff threats or US policy changes. Overall revenue growth could moderate but stay at healthy levels, with profit margins holding steady due to lower input costs. Most Asian corporates and banks will enter 2025 with strong balance sheets and adequate rating buffers. As the weakest credits in the Asia high-yield space have been removed, we expect a much lower default rate in 2025, along with a smaller percentage of fallen angel credits9 in the Asia investment grade space.

We expect to see higher gross supply in the Asia credit space in 2025 relative to the past two years, as the decline in US yields reduces the funding cost gap between offshore and onshore debt. Many regular issuers may also wish to refinance in the USD market to maintain a longer-term presence. However, net supply will likely be subdued given that redemptions remain elevated. At the same time, we expect demand from regional investors to stay firm given the still-high all-in yield.

While credit spreads are historically tight, the combination of supportive macro and corporate credit fundamentals, along with robust technicals, are expected to keep spreads rangebound for the most part in 2025. We remain cautiously optimistic and prefer the cross-over BBB- and BB-rated credit space trading in the low-to-mid 200 basis points (bps) spread. We anticipate carry to be the main driver of Asia credit returns in 2025.

*Forecast is not necessarily indicative of future performance

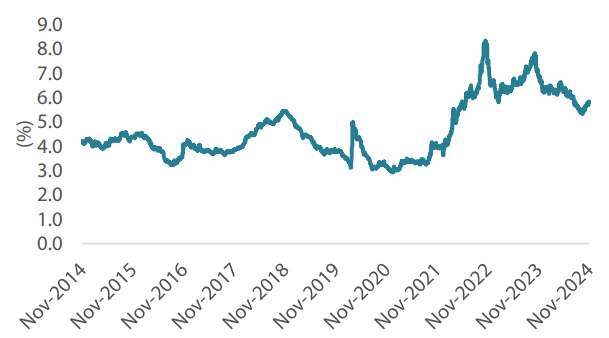

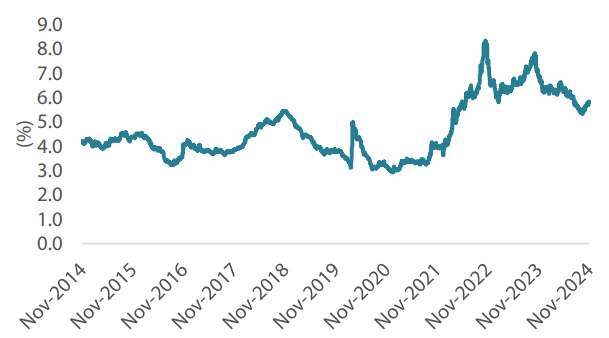

Chart 3: J.P. Morgan Asia Credit Index (JACI)

composite spread

Source: Bloomberg, Nikko AM Asia as at 18 November 2024

Chart 4: JACI composite yield-to-worst

Source: Bloomberg, Nikko AM Asia as at 18 November 2024

We favour financial subordinated debt, gaming and Chinese real estate State-Owned Enterprise (SOE)10 bonds

We favour financial subordinated debt, particularly in Hong Kong and Australia, for its attractive valuations that provide pick-up to similarly rated corporates. We also prefer the gaming sector, which is seeing an improvement in credit fundamentals as companies continue to focus on deleveraging and offers continued yield pick-up over US gaming peers. Bonds from Chinese SOEs in the real estate sector offer appealing yield pick-ups, and we expect these companies to continue to service their debt despite the challenging environment.

Cautious on Industrials, Hong Kong real estate and China long-end bonds

Conversely, some industrial sectors are facing weakening credit fundamentals due to slowing global growth, and we will remain cautious on this sector until there are signs of a sustained turnaround. We are cautious on the Hong Kong property sector given still-weakening fundamentals, and on China long-end SOE and technology sector bonds due to very tight valuations.

*Forecast is not necessarily indicative of future performance