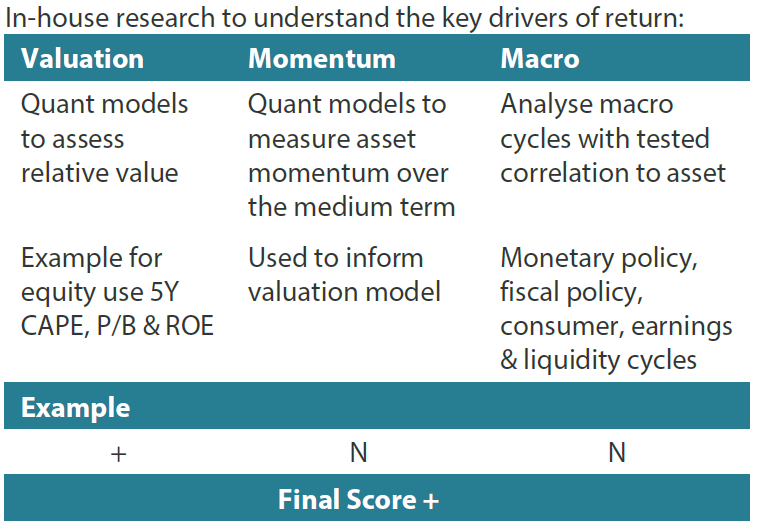

Cross-asset1

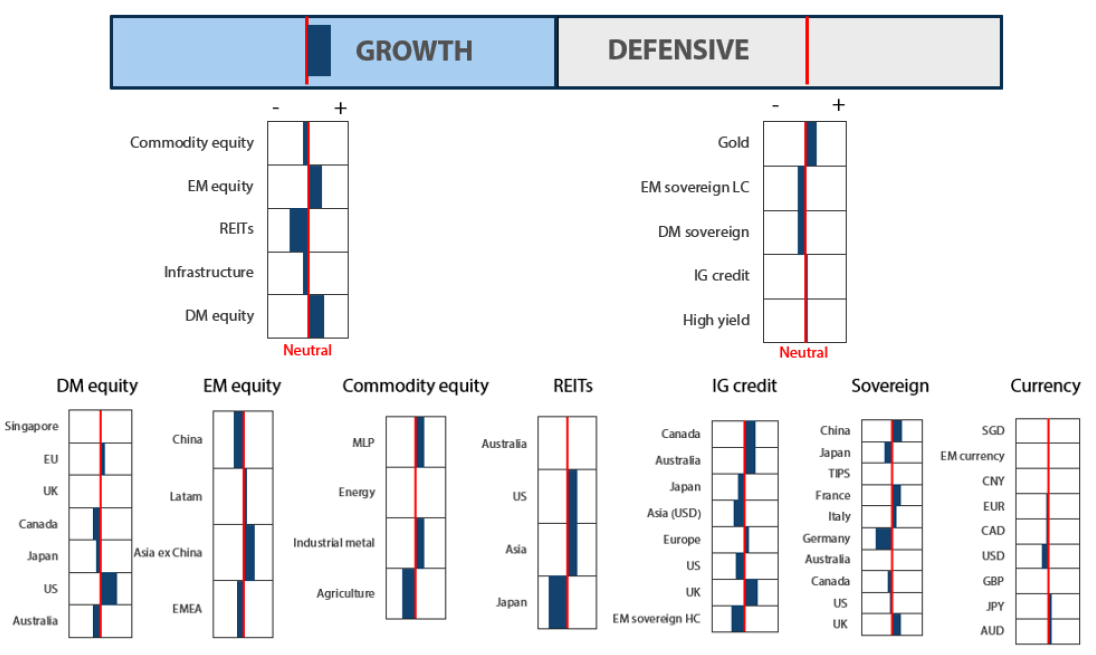

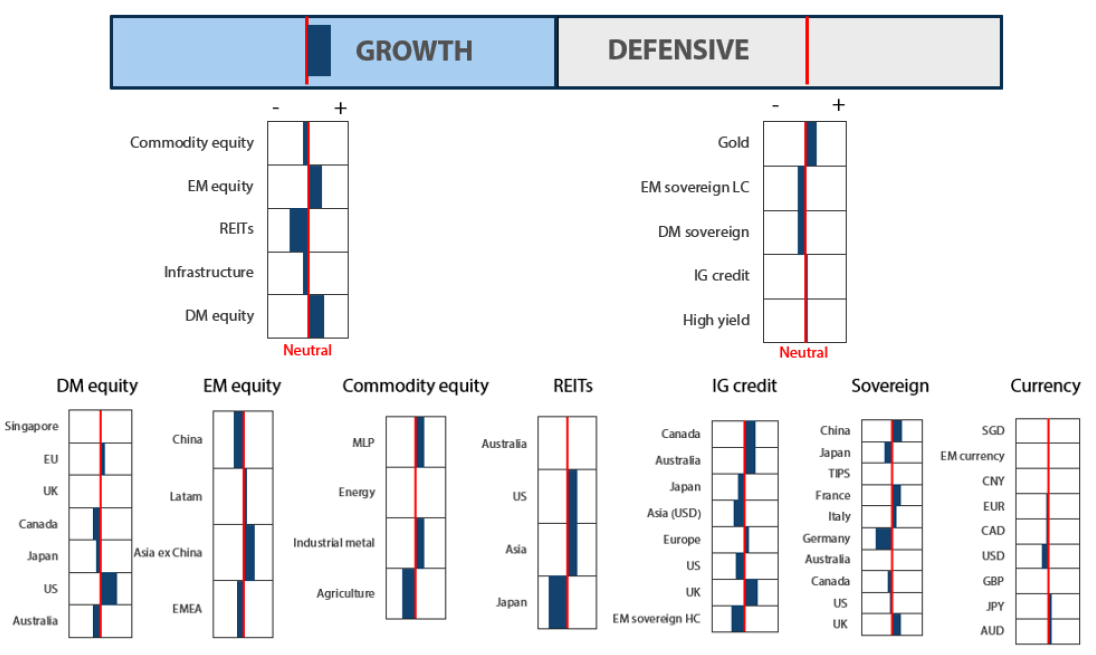

For the month of September, we increased our overweight growth position and maintained a neutral position on defensives. With respect to the growth assets, the start of the Fed’s pivot, initiated with a surprise 50-bps cut in September, was a boost to risk sentiment. Earlier concerns on the labour market were soon repelled by a strong jobs report. The resilient US economic data and declining inflation places the market in a goldilocks situation for risk assets. The coming earnings season would likely reinforce the risk sentiment if corporate earnings are stronger than market expectations and thus result in upside surprises. Likewise, global central banks have started their rate cutting cycle which sets up a positive environment for defensive assets.

Within the cross-asset scores of growth, we increased our overweight in both developed market (DM) and emerging market (EM) equities on the back of resilient economic data and increasingly dovish monetary policies globally. We rebalanced our risk exposures by adding to US and Europe (where we believe the coming earnings season should be positive due to relative valuation) and reducing our weight in Japan. Regarding the US, we continue to have a favourable view as secular growth themes create better visibility. Although we continue to like Japan for its longer term structural story of improving corporate governance and earnings growth momentum, we moved to underweight due to near-term headwinds created by yen volatility; we would, however, look to add capital on market corrections. We moved to an underweight in energy given growing oversupply amidst slowing demand; we also took profits off the more defensive MLPs given their strong performance recently. We are now underweight on infrastructure, which is expected to face headwinds from interest rate cuts. Within infrastructure, we still view US utilities favourably and added weights to the asset class to reflect our positive view on increasing energy demand on the back of secular growth of US data centres. We moved to an overweight position in EM equities on the Fed pivot and a weaker dollar, which would be positive for EMs. We continue to like selective countries like India and Indonesia which are expected to benefit from domestically-driven economies and structural long-term growth stories. Likewise, we also added weights to Taiwan, which is a beneficiary of the current global tech upcycle.

Within defensives, investment-grade (IG) credit was maintained at slightly overweight and DM sovereigns were kept as an underweight. The main shifts were EM local currency (LC) reduced to an underweight and gold increased to a larger overweight in place of the reduction. We still maintain a positive view on spread products as US economic growth is strong and dovish central bank policy is likely to support that outlook over the next six months. We continue to like a mix of Australia, Canada, and the UK as our key IG Credit market overweights, as these countries generate adequate levels of yield after hedging costs; they also have some ability to rally should global interest rates continue falling. We upgraded gold as typically this asset performs strongly during a rate-cutting cycle, and falling real yields should be beneficial to its performance. Elsewhere, we downgraded EM local currency sovereigns to reflect the currency volatility in the asset class, but we continue to like the yields that can be generated. Mexico had been a strong overweight over the past 18 months. However, we removed the overweight to Mexico last month to reflect the high levels of volatility which are being caused by investor concerns over the country’s judicial reforms.

1 The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View2)

2 The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

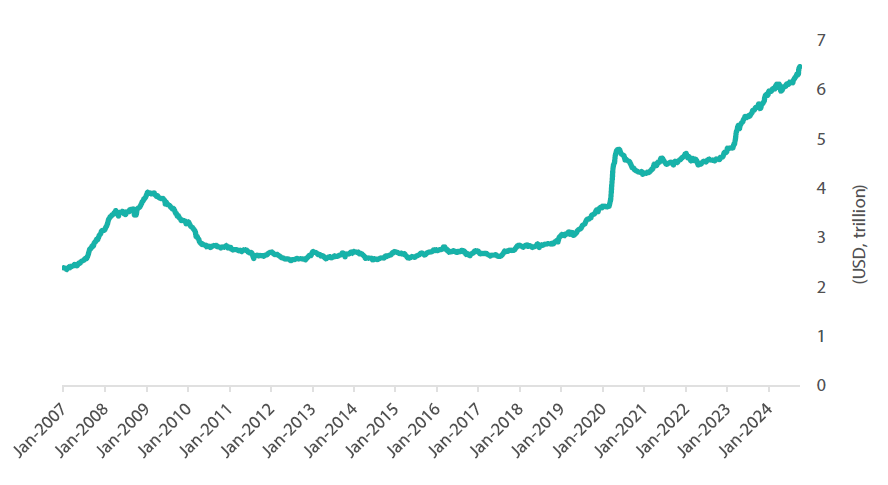

Growth assets

Growth assets are attractive given that economic data remains resilient against falling inflation and central banks globally are easing restrictive monetary policies. The likelihood of a hard landing continues to dissipate, although volatility could remain elevated amidst ongoing geopolitical risks. However, liquidity is supportive as there are USD 6.5 trillion of cash in money markets which could possibly flow into risk assets as interest rates continue to drop. The start of a rate cutting cycle to normalise monetary policy is a powerful driver of returns, and this is a welcome departure from the impact of restrictive monetary policies implemented over the past few years. We view any current market corrections as attractive entry points from the perspective of a longer term secular growth story.

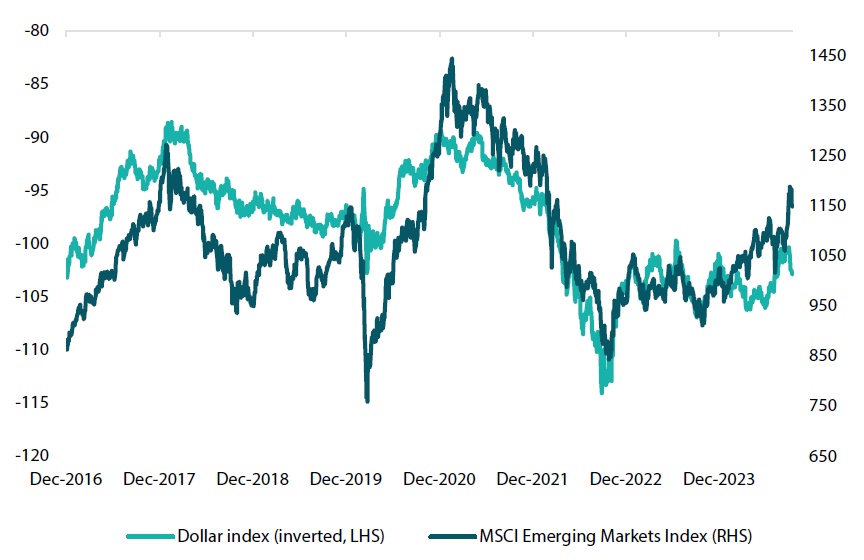

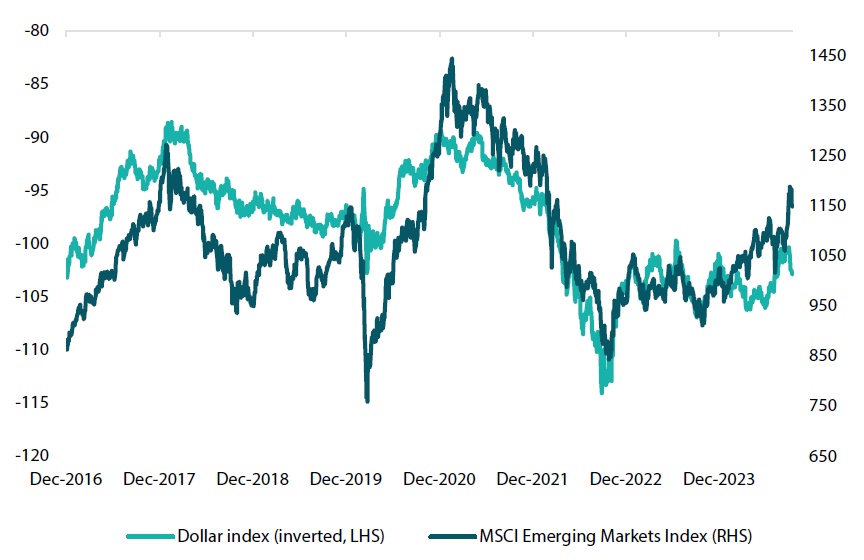

EM historically does well when the dollar weakens

With the start of the Fed’s easing cycle in September, the dollar is expected to weaken, which could provide a more supportive environment for EM. A weaker dollar is generally positive for global economic growth and emerging economies typically benefit from strong global growth. A weaker dollar also lowers the cost of borrowing, which is a further positive for EM companies. Historically, EM equities have performed well in periods of dollar weakness (Chart 1).

Chart 1: MSCI Emerging Markets Index benefits from a weaker dollar

Source: Bloomberg, October 2024

Likewise, EM central banks can now look to cut their own interest rates without having to defend their own currencies. Given the decrease in inflation and weaker economic data in these countries, the start of the rate cutting cycle is a welcome relief for reflating their economies.

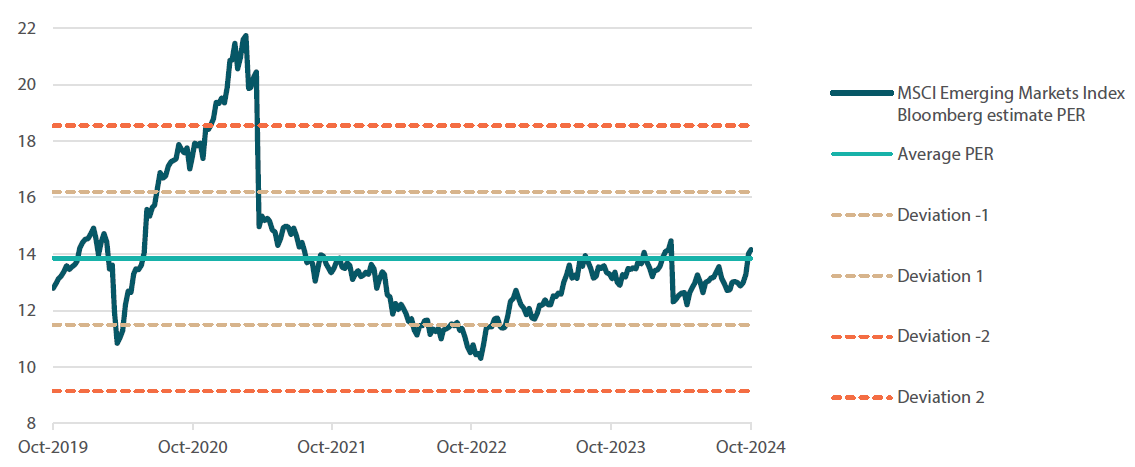

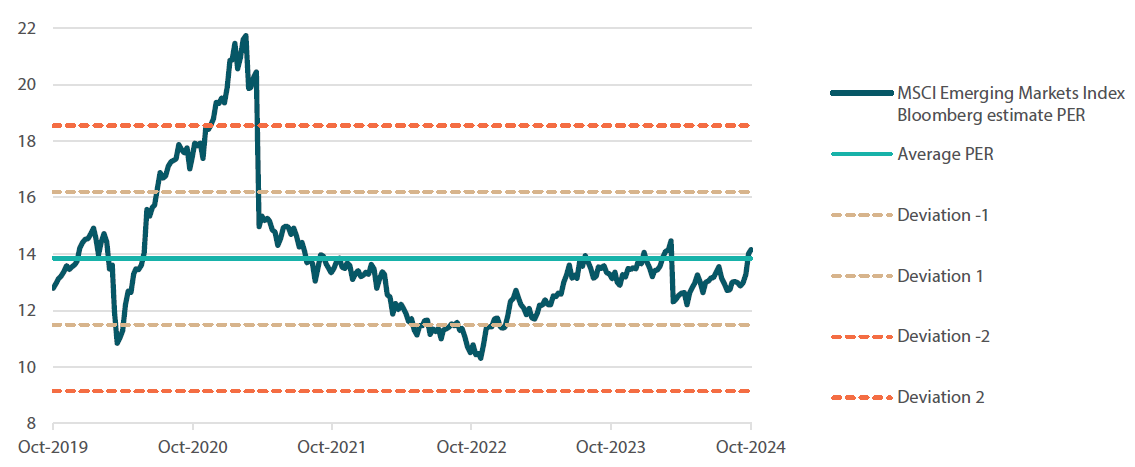

Despite the recent rally, EM valuation, in terms of PER, does not look stretched and is trading in line with its historical mean (Chart 2). Relatively, it looks attractive when compared to the rest of the world where valuations are currently at their upper band. Flows into the EM region have been increasingly positive recently and we expect them to continue on the back of further rate cuts from the Fed and a weakening dollar.

Chart 2: MSCI Emerging Markets Index valuation (PER) does not look stretched

Source: Bloomberg, October 2024

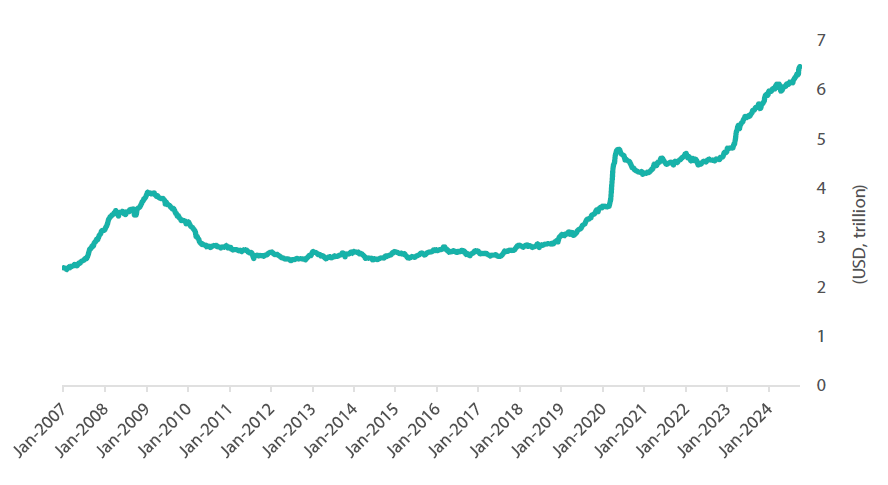

Furthermore, investors are ploughing billions into money market funds by the day (Chart 3). Since the start of the year, investors are estimated to have added another USD 557 billion to US money market funds. Retail investors currently hold close to USD 2.6 trillion of cash, with institutions making up the rest. Since 2022, the Fed embarked on the most aggressive pace of rate increases in decades which topped out at 5.5% in July 2023. The inverted yield curve also means short-end yields are yielding higher than the benchmark 10-year yield. The attractiveness of money market funds, T-bills and other short-term assets attracted the fastest pace of inflows since then.

Chart 3: Amount of liquidity in US money market funds a staggering USD 6.5 trillion

Source: Bloomberg, ICI, October 2024

With policymakers moving towards removing restrictive monetary policy and lowering interest rates, any moves away from money markets could potentially drive the valuation of risk assets higher. The timing and amount of these reductions is worth noting in the coming months.

Conviction views on growth assets

- Increased exposure to US secular growth: We continue to like US tech-related stocks despite market concerns regarding the returns expected on investments made on artificial intelligence and data centres. Corporate earnings have been resilient and the secular long-term growth story for the sector remains intact. Within the US, we are also starting to see the rally widening beyond the “Magnificent 7” which is positive for the overall market. As inflation comes under control amidst more dovish monetary policy, risk assets are expected to do well in the US.

- Increased exposure to EMs: We increased our overweight position in EMs based on relative valuation. With the start of the rate cut cycle in the US, a weaker dollar is typically positive for EMs. We like selective markets in India and Indonesia which benefit from domestically-driven economies and structural long-term growth stories. Likewise, we like Taiwan for its exposure to the global technology upcycle and as a beneficiary of a weaker dollar.

- Reduced Japanese equities: We moved to an underweight in Japan equities amid increasing yen volatility. We still like Japan’s structural reform story where we expect companies to increase their capital and dividend returns to shareholders. However, the volatility of the yen and a hawkish BOJ juxtaposed against dovish central banks globally also pose headwinds to sentiments. We will turn more positive on the country once we see the currency stabilising.

- Reduced commodity-linked equities and infrastructure, increased US utilities: Given the slowing economic data and energy oversupply, we have reduced our exposure in commodity-linked equities. We rebalanced the weights from MLPs (classified under commodity-linked equities) on profit taking into US utilities (classified under infrastructure) amid improving energy demand in the US from data centres. As for infrastructure as a whole, we tactically reduced our weights in the near term; however, we remain confident that the asset class will continue to provide good diversification against inflation in the longer term as fundamentals remain compelling on both cyclical and secular factors.

Defensive assets

One of the key changes over the past month was an increase in our gold score, reflecting our view that the precious metal will remain in a bullish environment as central banks ease rates globally. Additionally, for the past 12 months, we have been negative on sovereign bond allocations, as credit spreads were viewed more favourably and the highly inverted bond yield curves made it problematic to own long dated exposures. As central banks ease, however, we look to favour a small overweight to duration, as typically when the Fed cuts rates bond curves steepen and this may bring renewed opportunities to look at sovereign bonds in the following months. Finally, as economic growth remains buoyant in the US, and more dovish policy sets in, we expect credit spreads to perform well. However, we are fast approaching levels where additional spread compression will be very hard to come by.

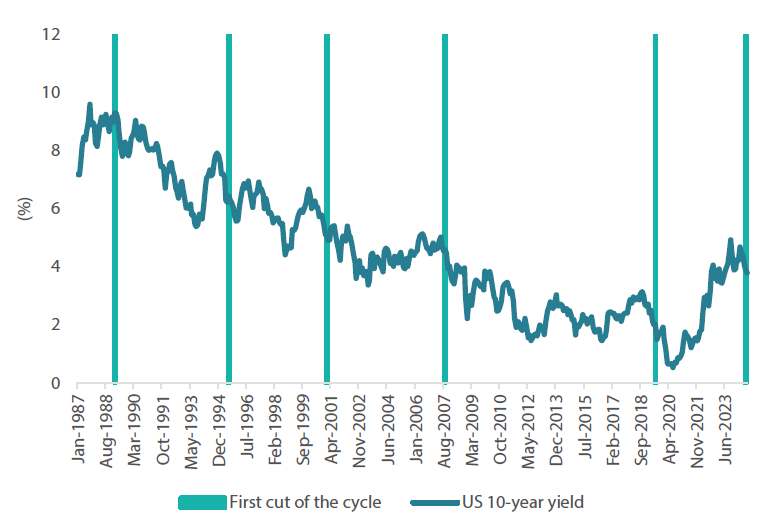

The Fed returns

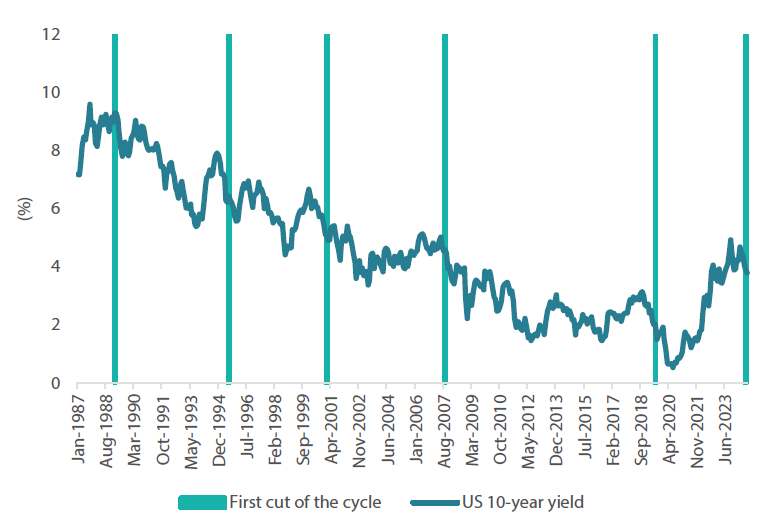

After beginning its interest rate hiking cycle in March 2022 and hiking over 500 bps, the Fed now deems that inflation is likely returning to more sustainable levels. This warranted a 50 bps rate cut in order to bring monetary policy out of restrictive territory. While we were somewhat surprised by the Fed’s willingness to move 50 bps, clearly the inflation outlook is moving into a more normal environment whereby the Fed can reduce the cash rate towards 3.50% to bring the real rates in the economy closer to their long run average. While over the past 12 months we have been cautious on adding duration, more recently, we have been favouring a move towards a neutral/small overweight position. As Chart 4 below shows, once the Fed starts an easing cycle, the environment for bonds generally becomes more positive. And as a simple rule while trying not to trivialise active duration decisions, we can state that when the Fed is tightening, be wary of bonds and when they are easing, re-allocate.

Chart 4: US 10-year bond yield and first cut of the cycle

Source: Blomberg October 2024

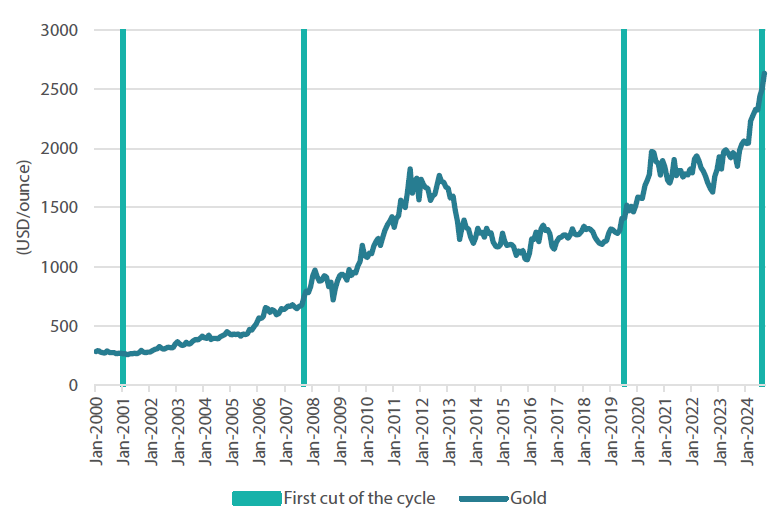

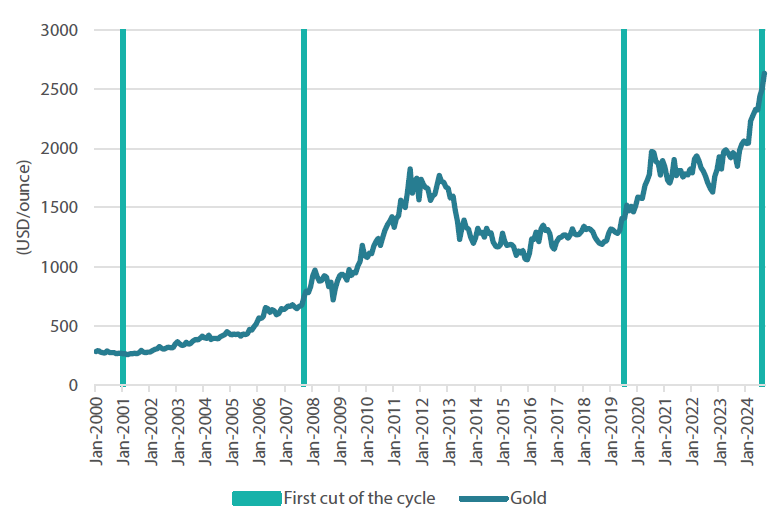

Additionally, when the Fed lowers rates, gold typically performs particularly well. While this is not true of all occasions over the past 50 years, it has been a very consistent rule to follow since the 2000s. Chart 5 below shows the performance of gold following the first cut of the cycle, with prices running 6%, 17%, and 39% over the following 12 months after the initial cut. Over the past 12 months, gold has already posted an astonishing 43% gain in dollar terms, handily outperforming global equities. We expect this to continue over the near term, as falling interest rates should be beneficial to the asset class; additionally, the large amounts of sovereign deficit funding is also viewed as a positive for gold.

Chart 5: Gold price and first cut of the cycle

Source: Bloomberg, September 2024

From a portfolio perspective, the dovish policy actions from the Fed are creating a number of opportunities for positioning. This is detailed not only in the EM equity positions driven by the weak dollar, but also more optimistic positioning for sovereign bonds and gold allocations. The drawback is that in Japanese yen terms, the bond market is still negative yielding, due to high hedging costs. However, as yield curves steepen, we see this becoming less of a problem over the next six months.

Conviction views on defensive assets

- Short-dated IG credit: Credit spreads remain at fair levels, but many markets still exhibit inverse yield curves, making longer-dated credit less appealing. As curves begin to steepen, we will look to shift this position. However, the current curve inversion still makes short-dated positions appealing.

- Gold remains an attractive hedge: Gold has been resilient in the face of rising real yields and a strong dollar, while proving to be an effective hedge against geopolitical risks and persistent inflation pressures. Falling real yields should benefit the asset class, and we use this allocation to supplement our long bond positioning.

- Adding duration: Central banks beginning to lower rates should be beneficial to bond markets globally. Picking the timing for rate cuts can be difficult; however, as restrictive policy comes to an end, this should be positive for bonds. Long-dated bond yields are still inverted, making large allocations expensive. However, as curves begin to steepen, continuing to add duration becomes an option.

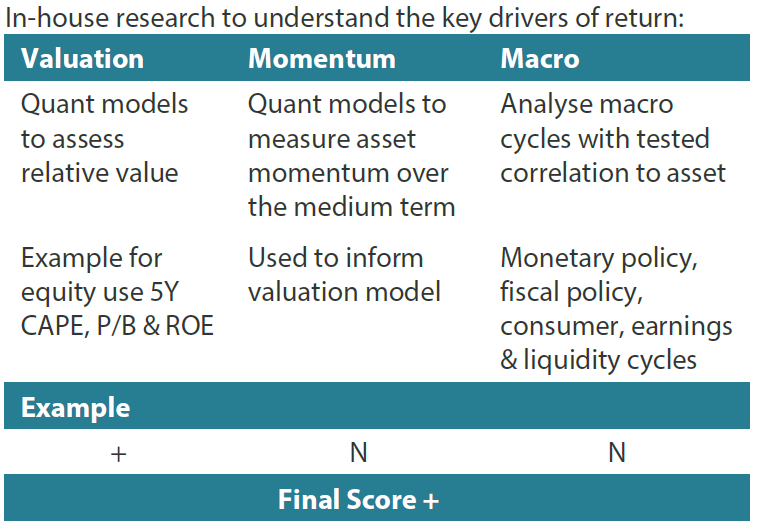

Process