Market review

Asian shares climb in September

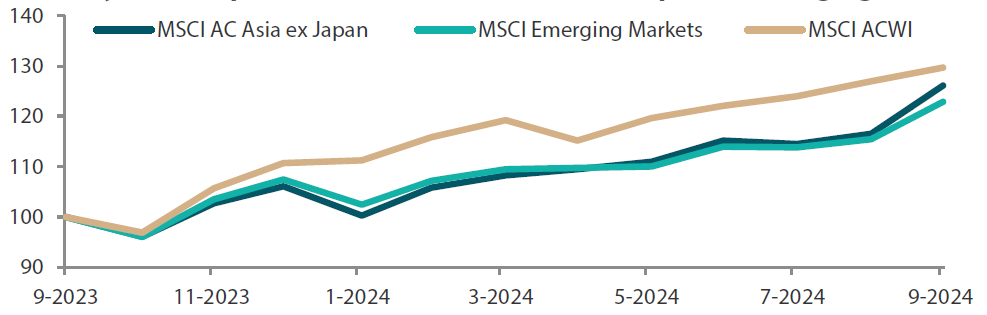

Asian stock markets rallied in September following the Fed’s widely anticipated decision to reduce interest rates. This move is seen to have initiated a series of rate cuts. The US central bank lowered the federal funds rate by a significant 50 basis points (bps) to a 4.75% to 5% range. Fed Chair Jerome Powell said the move was “a good strong start” judging from current economic conditions. Key US indicators over the past two months such as retail sales, consumer sentiment, industrial production and manufacturing output mostly beat market expectations, signalling that the economy remained in good shape. The MSCI AC Asia Ex Japan Index gained 8.4% in USD terms for the month.

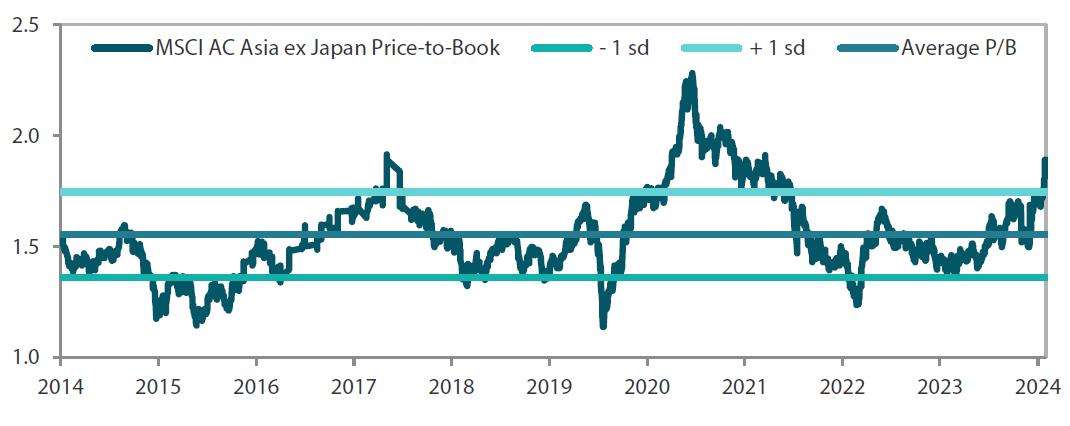

Chart 1: 1-yr market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

Rescaled to 100 on September 2023.

Source: Bloomberg, 30 September 2024. Returns are in USD. Past performance is not necessarily indicative of future performance.

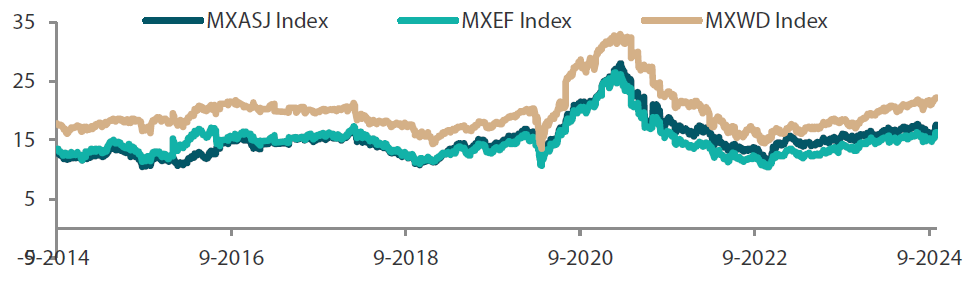

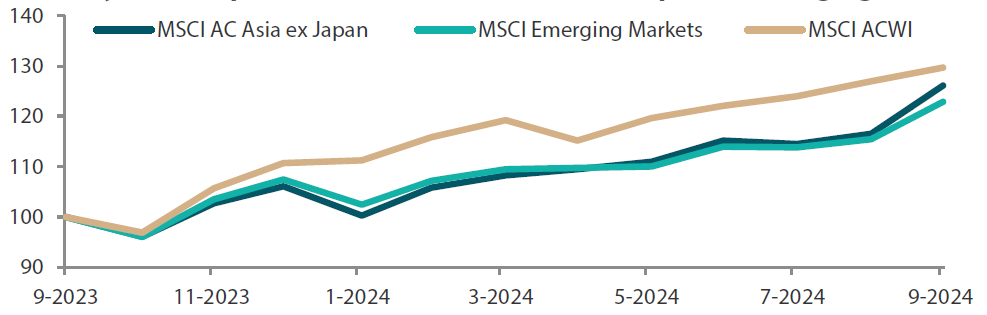

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 30 September 2024. Returns are in USD. Past performance is not necessarily indicative of future performance.

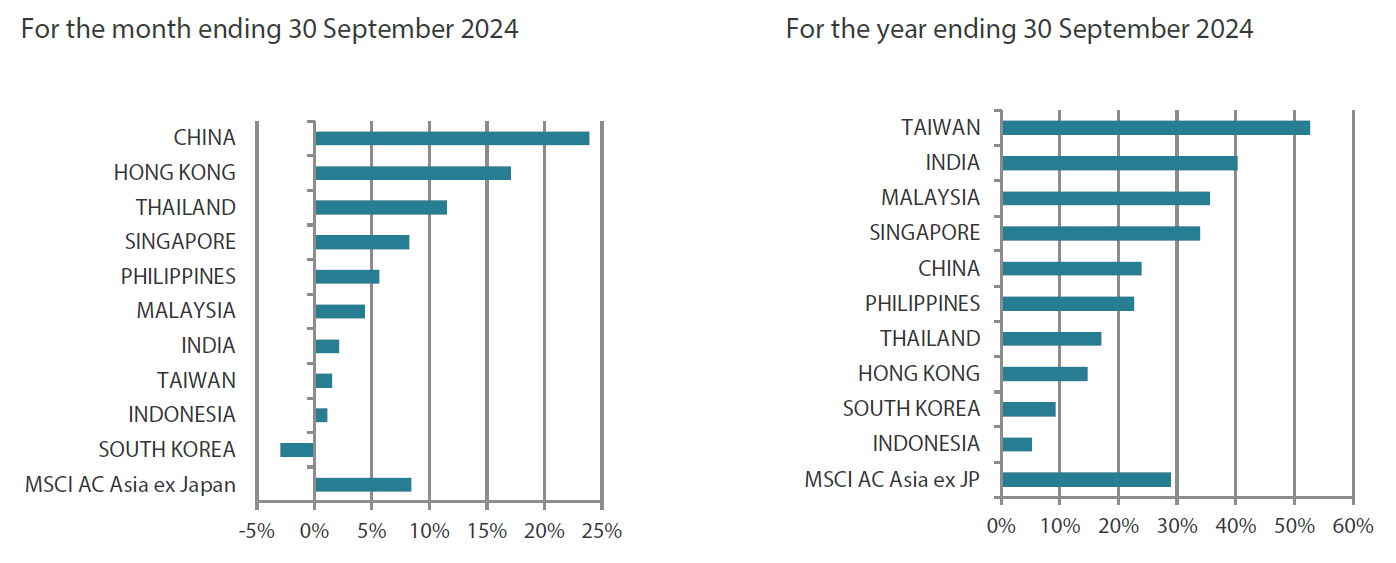

North Asia gains led by China

In North Asia, China shares climbed 23.9% for the month to outperform the region as investors cheered a slew of government measures unveiled to tackle sluggish growth. In response to the news, the Chinese renminbi (RMB) also touched its highest level against the dollar in over a year.

In a rare move, PBOC Governor Pan Gongsheng, along with two other financial regulators, held a press conference to announce reductions to the reserve requirement ratio for banks and the seven-day repo rate as well as a likely cut to the loan prime rate to improve liquidity conditions. Local stock markets also received a boost in the form of a RMB 500 billion swap facility for non-bank financial firms to purchase shares, and plans for an RMB 300 billion re-lending programme for listed companies and majority stakeholders to conduct share buybacks.

The property sector, in which many Chinese have heavily invested, saw cuts to existing mortgage and second home downpayment rates. Separately, a one-time cash handout will be offered to those in need. Chinese President Xi Jinping also reiterated these moves in a monthly Politburo meeting shortly after and pledged to stem the decline in property prices, support household income growth, boost capital markets and address rising joblessness among youths and migrant workers.

The sweeping initiatives came on the back of elevated unemployment and inflation in China, while industrial production, manufacturing activity and retail sales remained downbeat in August. The Chinese authorities also raised the statutory retirement age to relieve the strain on the national pension system as the population ages rapidly. Elsewhere, the Hong Kong market gained 17.1% as investors digested an interest rate cut from the territory’s monetary authority and the news about the mainland’s stimulus. Jobless rates and inflation in Hong Kong remained stable over August.

In South Korea, the market retreated 3.0% in September on concerns that the strength of the Korean won could hurt exporters. Data in the preceding month pointed to a robust economy where the consumer price index fell while factory activity, industrial output and exports gathered pace. Meanwhile, the South Korean Value-Up Index, comprised of 100 firms chosen for their profitability and shareholder returns, was officially launched to combat the chronic issue of domestic shares trading at a discount.

Taiwan shares (+1.5%) gained on robust exports, which rose to a record monthly high in August. The central bank upped growth estimates for the year as the export-oriented economy is expected to benefit from robust global demand for emerging technologies, but it still left interest rates unchanged. Inflation in August eased but stayed above the central bank’s 2% target as the effects of Typhoon Gaemi led to higher fruit and vegetables prices.

ASEAN markets advance on Fed and PBOC cues

Among the ASEAN economies, the Singapore market (+8.3%) was lifted by news of the Fed’s rate cut and the PBOC’s stimulus measures. Encouraging readings for factory output and non-oil domestic exports, together with a stable jobless rate also aided sentiment even with a slight uptick in August core inflation.

In Malaysia (+4.4%), investors looked past tepid manufacturing data and a narrower trade surplus to focus instead on the aforementioned positive cues.

Meanwhile, Thailand (+11.5%) launched the first phase of a Thai baht (THB) 145.5 billion cash stimulus package for state welfare card holders and the disabled as it looks to shore up a flagging economy. These individuals will receive THB 10,000 through the official e-payment system. However, a minimum wage hike was postponed as it failed to garner sufficient support from decision makers. The country’s manufacturing purchasing managers’ index (PMI) continued to expand in August, albeit at a slower pace.

In the Philippines (+5.6%), Finance Secretary Ralph Recto signalled that the central bank was likely to match the Fed’s 50-bps rate cut as inflation eased. His comments came shortly after the monetary authority’s decision to lower the reserve requirement ratio for banks.

Indian markets tick higher

India (+2.1%) advanced thanks to factors including strong domestic inflows and the rowth in the April-June quarter eased to 6.7% year-on-year from 7.8% in the previous period as agricultural and service sector weakness weighed on the economy. Based on initial readings, India’s September manufacturing PMI slipped from a month ago but remained in expansionary territory. The trade deficit in August widened as exports were hit by geopolitical trade disputes, weaker oil prices and higher shipping costs. Imports jumped on good demand for gold in that month. In response to this weakness in exports, the Indian authorities unveiled measures to lower ocean freight costs, increase the supply of shipping containers, speed up export procedures and to reduce congestion at ports.

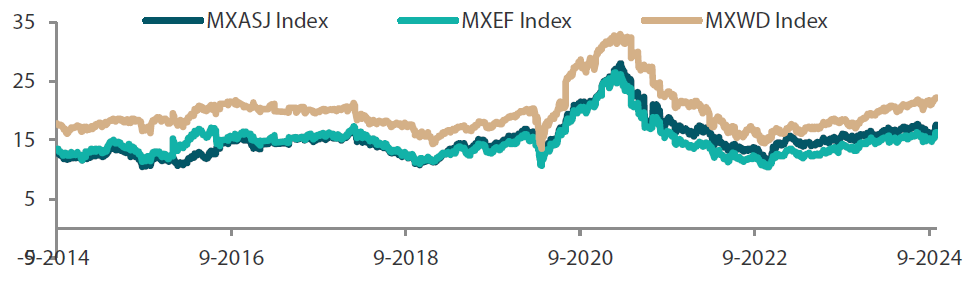

Chart 3: MSCI AC Asia ex Japan Index1

Source: Bloomberg, 30 September 2024.

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Two catalysts for the Asian market: Fed’s rate cut and China’s stimulus

We expect potential support for the Asian market from two significant catalysts. The first is easing by the Fed with the market expecting further rate cuts at the next Federal Open Market Committee Meeting. Easing by the Fed gives Asian central banks room to lower rates which is very supportive for domestic growth. The second is the slew of coordinated financial support policies rolled out by the Chinese government agencies. We explain the potential for more Chinese stimulus in the section below.

Chinese markets to see further gains as more stimulus expected

Amid market expectations for more stimulus measures from China, the PBOC has hinted at more cuts to the reserve requirement ratios, which would release money to the banks. There is also talk of recapitalising Chinese banks. We see the current sharp “everything” rally as a short-term boost and continue to assess stocks with a focus on fundamental support and earnings growth. Overall, we expect domestic and foreign asset allocation into Chinese equities to pick up pace and lift the entire market.

Bullish on Asia ex-Japan earnings

Looking at company fundamentals, second-quarter results from Asia ex-Japan markets were strong, with 50% of companies beating expectations. Earnings revisions are positive, especially in Malaysia, South Korea and Taiwan. We expect to see significant earnings upgrades in China and Hong Kong into 2025. The technology sector is leading in terms of earnings growth. However, we expect a possible shift towards interest rate-sensitive businesses, consumer names and transport as consumption, tourism and general spending and investment gather pace. Energy and materials continue to be laggards, and we expect them to remain in this pattern due to an absence of tangible demand. China had been the marginal buyer of energy and materials. However, with the shift in its industrial and capital deployment policies, we do not expect China to return as a source of marginal demand.

Still positive on India macroeconomic situation; focus on Malaysia in ASEAN

We continue to view India positively, believing that the structural changes in the country’s economy, consumer habits and investments will persist for the foreseeable future. Macroeconomic conditions remain favourable and without inflationary pressures, its central bank is expected to continue supporting the economy. Year-to-date, it has been domestic, not foreign, flows that have driven the Indian market higher. However, it could lag relative to China as investors become more confident in the revival of the Chinese economy and allocate more there instead of India.

In ASEAN, we have talked about Malaysia as an emerging destination for investments. We expect this to continue with the country reinventing itself as a technology production alternative and data centre provider.

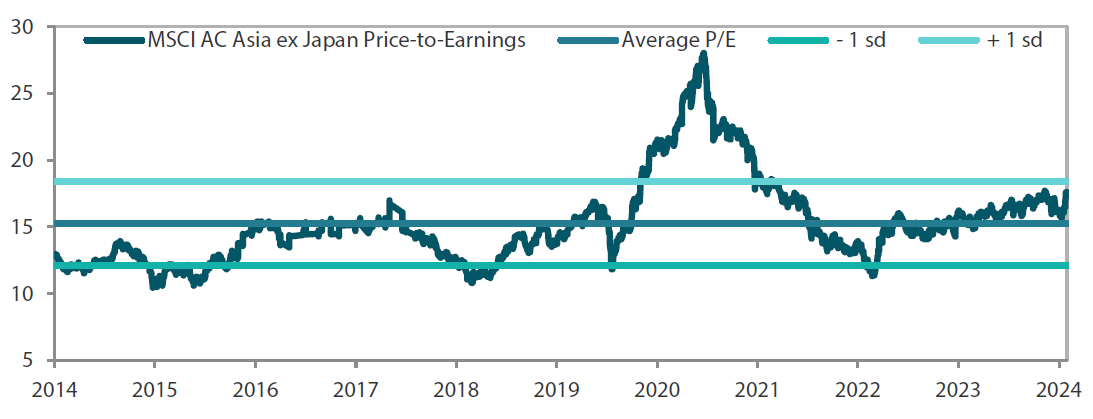

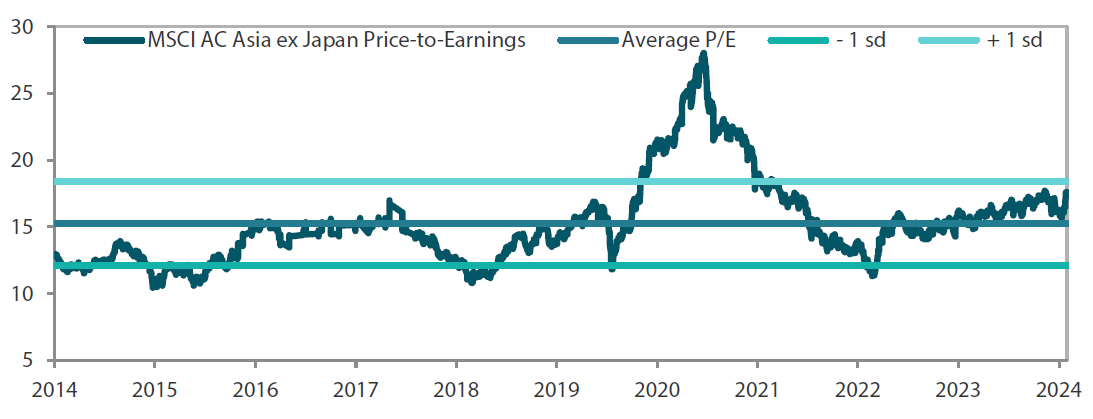

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 30 September 2024. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

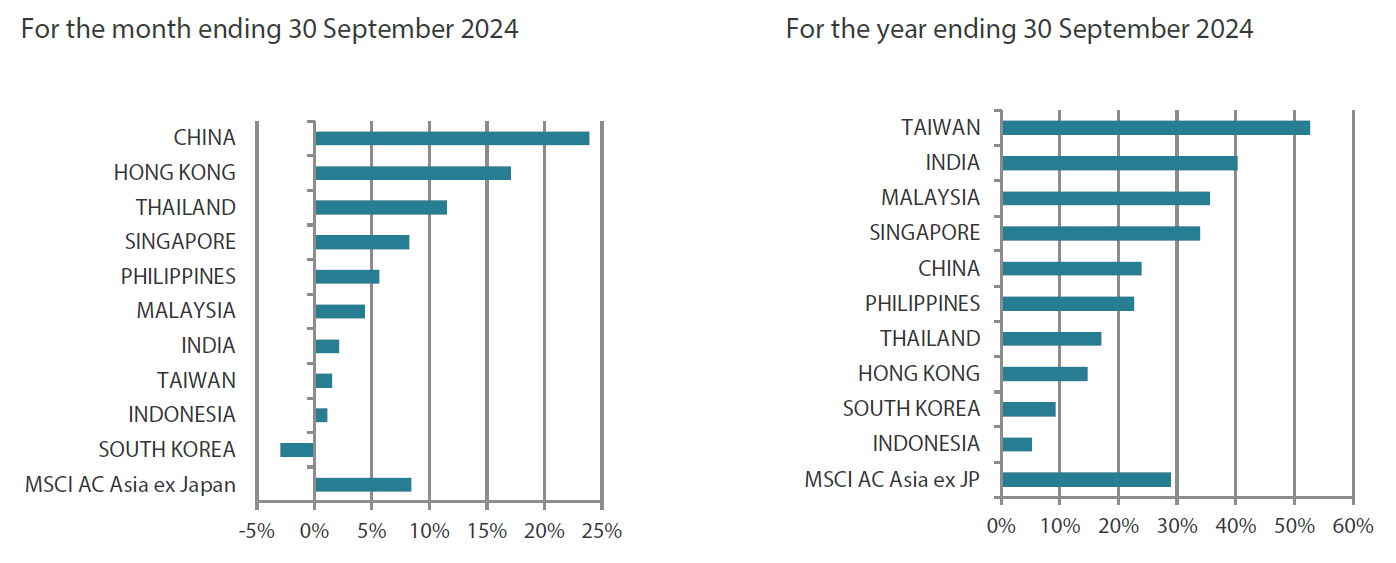

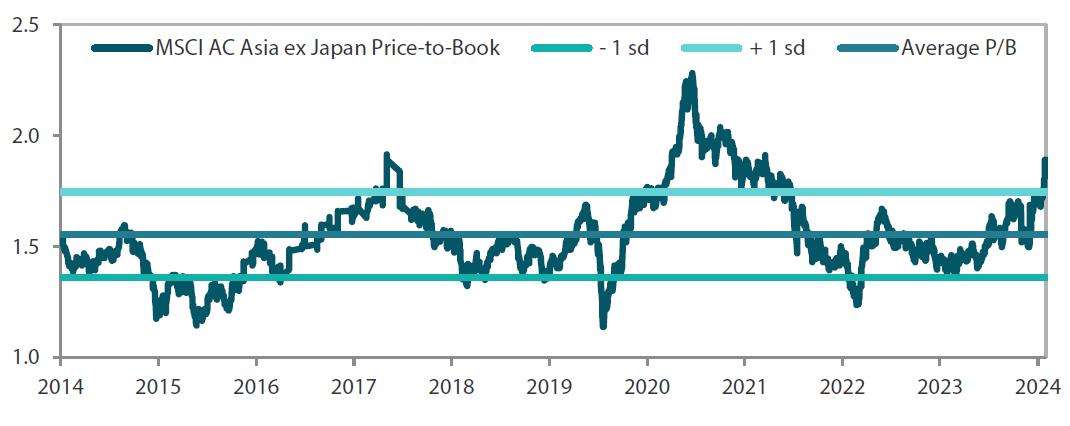

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 30 September 2024. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.