Summary

Early on in the month, volatility gripped US Treasury (UST) yields due to increasing global macroeconomic uncertainties stemming from US tariff policies. Later in March, the US Federal Reserve (Fed) opted to stand pat on monetary policy. The benchmark 2-year UST yield ended the month at 3.89%, about 11 basis points (bps) lower compared to the end of February, while the 10-year UST yield ended the monthly little changed at 4.21%.

Within Asia, central banks in Malaysia and Indonesia kept policy rates steady amid the cloudy global outlook. Additionally, inflationary pressures eased in February.

We continue to believe that Asia’s local government bonds are positioned to peform decently in 2025, supported by accommodative central banks amid an environment of benign inflation and moderating growth. Within the region, we expect investor appetite to remain firm for higher yielding bonds such as those of Malaysia, India, Indonesia and the Philippines relative to their regional peers.

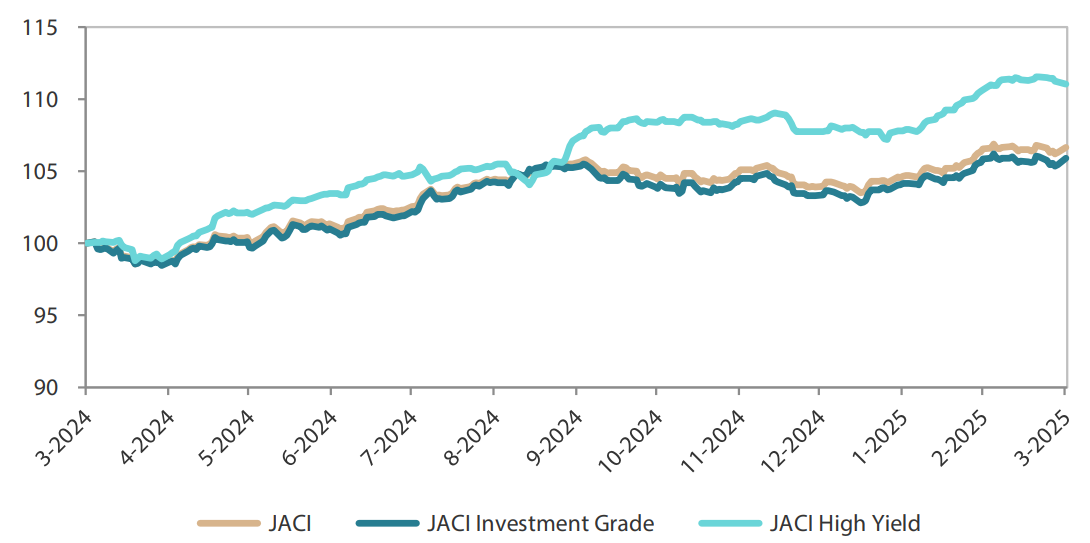

Asian credits gained 0.09% in March, as a decline in UST yields helped offset the impact of wider credit spreads. Asian investment grade (IG) credits underperformed Asian high-yield (HY) credits, with IG credits returning +0.04%, despite spreads widening by 17.7 bps. Asian HY credits rose 0.37%, despite a 1 bp increase in spreads.

While uncertainties loom over the trajectory of US economic growth and the Fed’s policy direction, most Asian economies have entered this period of higher volatility with relatively robust external, fiscal, and domestic demand conditions. We expect these factors to provide a good buffer to withstand the challenges ahead. Against this more challenging but still benign macroeconomic backdrop, we expect Asian corporate and bank credit fundamentals to stay resilient, aside from a few sectors and specific credits which may be affected by tariff threats or geopolitical dynamics.

Asian rates and FX

Market review

The Fed leaves interest rates unchanged in March

The month began with some volatility in UST yields, fuelled by rising global macroeconomic uncertainties tied to trade tensions and geopolitical developments. US President Donald Trump’s inconsistent approach to tariff policies unsettled markets, heightening concerns about inflation and growth. Over in Europe, Germany’s decision to ease its “debt brake” as part of its efforts to revitalise its sluggish economy and increase defence spending added to upward pressure on global bond yields and dampened risk sentiment. Mid-month, the Fed opted to keep interest rates unchanged, citing slower US growth and higher inflation due to increased uncertainties. Yields rose again following reports that Trump’s planned reciprocal tariffs would likely be more targeted than previously expected. The 2-year UST yield ended the month at 3.89%, about 11 basis points (bps) lower compared to the end of February, while the 10-year UST yield ended the monthly little changed at 4.21%.

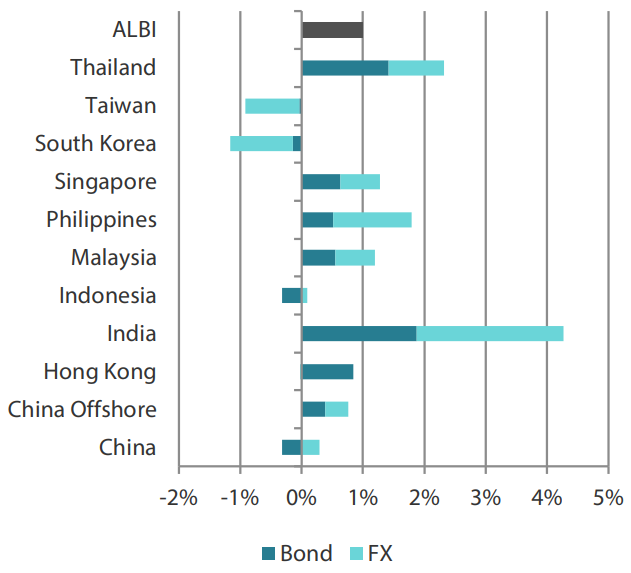

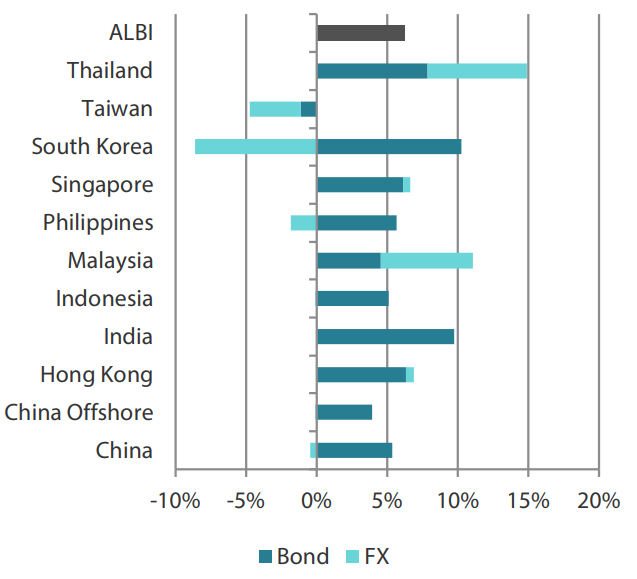

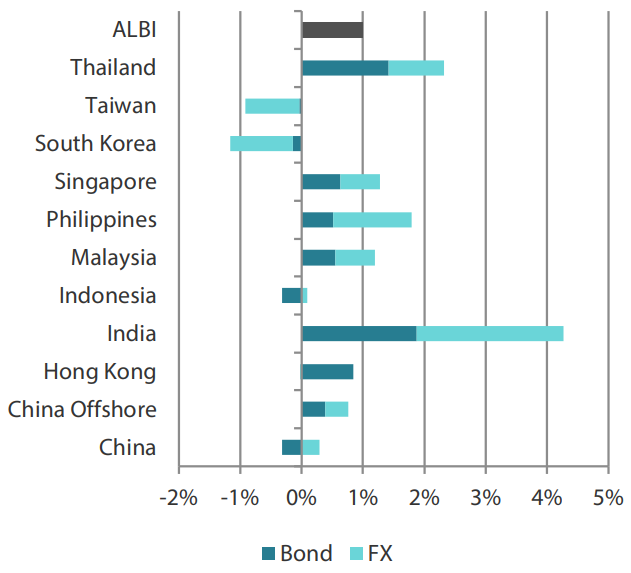

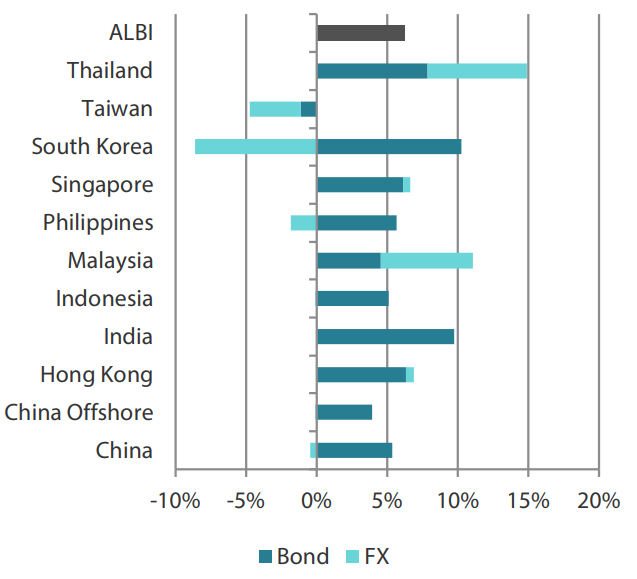

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 31 March 2025

For the year ending 31 March 2025

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 March 2025.

Central banks in Malaysia and Indonesia keep their policy rates unchanged

Bank Negara Malaysia (BNM) decided to keep its benchmark interest rate unchanged, citing a balanced outlook for both growth and inflation. While export growth may moderate due to rising trade tensions, the tech upcycle and tourism recovery could provide additional support. However, BNM also acknowledged persistent downside risks, particularly from slower growth in key trading partners and weaker commodity output.

Similarly, Bank Indonesia (BI) kept its interest rates steady at 5.75%, in line with its goal of keeping inflation within target while supporting economic growth. BI Governor Perry Warjiyo expressed confidence in Indonesia’s economic outlook, noting that growth remains steady despite global uncertainties, driven by strong household consumption, government spending and rising non-oil exports, especially palm oil and motor vehicles.

Meanwhile, a normalisation of food and energy prices, along with delayed effects of past policy tightening, has contributed to easing inflation across most countries in the region.

China sets a growth target of “about 5%” for 2025, again

China set an ambitious growth target of “about 5%” for 2025 for the third consecutive year. To reinvigorate its sluggish economy, the government pledged to increase spending and stimulate domestic demand amid escalating trade tensions with the US. By mid-month, policymakers unveiled a plan to expand domestic consumption (interestingly, the term "consumption" was mentioned over 30 times in Prime Minister Li Qiang's annual report), featuring measures such as wage increases, higher pensions and incentives for childbirth. The government also pledged to strengthen household wealth, revitalise the stock and property markets and increase funding for artificial intelligence. However, it is worth noting that the plan lacked detailed implementation strategies.

Market outlook

Regional bond markets could see further support from dented economic confidence

We continue to believe that Asia’s local government bonds are positioned to perform well, supported by accommodative central banks amid an environment of benign inflation and moderating growth. Global markets are still struggling to digest last week’s seismic tariff shock, but concerns over further potential growth impacts from US tariffs are likely to provide additional support for regional bond markets.

Within the region, demand for higher-yielding bonds in Malaysia, India, Indonesia and the Philippines is expected to remain firm relative to regional peers. Additionally, government bond yields in India, Indonesia and the Philippines could decline further, as we anticipate further monetary easing by their central banks in 2025.

As we mention in "Impact of additional US tariffs on Asia rates and credit markets",“ we retain a positive outlook for several countries that have more policy space to pre-emptively implement monetary and fiscal policy response to absorb any economic drags and disinflationary impacts. Meanwhile, we are closely monitoring conditions in the markets. We are particularly focused on those with shallower market depth in the event global outflows accelerate or if market functioning becomes impaired.

Amid the persistent uncertainties associated with the Trump administration, we remain broadly cautious on Asian currencies in near term. However, we see the region’s strong economic fundamentals softening the blow, with the Malaysian ringgit remaining our preferred currency.

Asian credits

Market review

Asian IG credits eke out slight gains in March

Asian credits delivered a modest return of +0.09% in March, as a decline in UST yields helped offset the impact of wider credit spreads. Asian IG credits underperformed Asian HY credits as their spreads widened considerably relative to those of HY. IG credits returned +0.04%, with spreads widening by 17.7 bps. HY credits gained 0.37%, with spreads widening by 1 bp.

Global trade tensions and geopolitical developments took centre stage at the beginning of March, dampening risk sentiment and leading to a widening of credit spreads. While the National People’s Congress meeting stole the limelight in China, concerns over deflation persisted as consumer inflation turned negative in February. Credit data for the month also fell short of expectations, while activity data for the first two months of the year exceeded forecasts. Chinese policymakers’ plan to cope with challenges in 2025 boosted sentiment towards Chinese credits, particularly HY names, although the absence of concrete implementation details limited gains.

Meanwhile, uncertainty surrounding the US growth and inflation outlook—exacerbated by the unpredictable nature of US tariff policies—continued to weigh on overall risk sentiment. The combination of heightened uncertainty and heavy new issuance kept overall credit spreads under pressure. By the end of March, credit spreads had widened across all major country segments.

Indonesian credits were particularly affected by concerns over potential shifts in the country’s hitherto prudent fiscal policy stance, along with concerns about transparency and governance related to Danantra, the newly created state-owned holding company intended to be the ultimate holding company for all Indonesian state-owned enterprises in the future. Additionally, reports that Chinese authorities opposed a Hong Kong conglomerate’s planned sale of certain port operations—which resulted in a delayed transaction—weighed on the conglomerate and related Hong Kong credits.

Primary market activity picks up pace in March

Following a period of limited supply in February, the primary market experienced a surge in issuance in March, mainly driven by IG-rated issuers. During the month, the IG space saw 33 new issues totalling USD 21.93 billion. Notable issues included the massive USD 5.0 billion three-tranche issue from Petronas Capital Ltd., the USD 3.0 billion three-tranche issue from MTR Corp Ltd., the USD 2.0 billion three-tranche issue from DBS Group Holdings, the USD 2.0 billion four-tranche issue from LG Energy Solution, and the USD 2.0 billion three-tranche issue from United Overseas Bank. Meanwhile, the HY space saw 7 new issues totalling USD 2.9 billion.

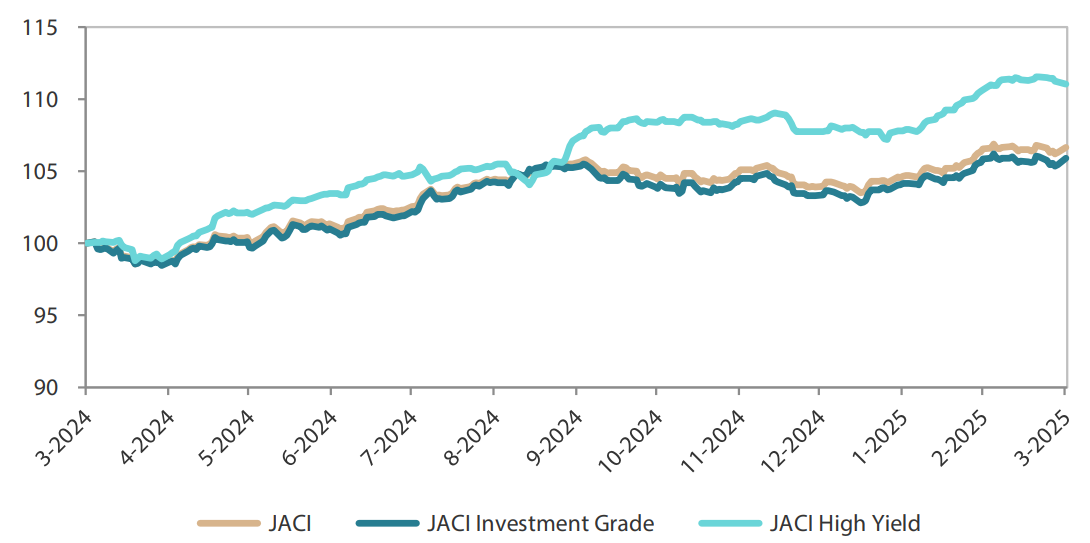

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 March 2024

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 March 2025.

Market outlook

Better spread valuation, supportive credit fundamentals and robust demand-supply technicals to support medium-to-long term performance of Asian credits

Intensifying trade and tariff-related uncertainties, coupled with question marks over the trajectory of US economic growth and the Fed’s monetary policy, are expected to present some challenges to external demand and Asia’s macroeconomic fundamentals in the near term. Certain country-specific developments, such as potential fiscal policy shifts in Indonesia, also bear monitoring. However, most Asian economies entered this period of higher volatility with relatively robust external, fiscal, and domestic demand conditions, which should provide a good buffer against the challenges ahead.

Chinese authorities continue to roll out fiscal and sector-specific policies to support domestic consumption and investments, as well as to stabilise the stock and property markets. In addition, most of Asia’s central banks retain some room to ease monetary policy to support domestic demand. Against this more challenging but still benign macroeconomic backdrop, we expect Asian corporate and bank credit fundamentals to stay resilient, aside from a few sectors and specific credits which may be affected by tariff threats or geopolitical dynamics.

The unexpected surge in new issuances in the Asia credit space towards the end of March resulted in some indigestion, which will require some time to settle amidst the volatile market environment. However, for the full year, gross and net supply in the Asia credit space is still expected to remain benign. Additionally, we expect demand from regional investors to stay firm barring a sharp and sustained fall in all-in yields. The widening of Asia credit spreads in March after a long period of compression is viewed as a healthy development as it creates more attractive entry points. The better spread valuation, combined with still supportive credit fundamentals and decent demand-supply technicals, are expected to support the medium-to-long term performance of Asian credits.