Pricing in risks associated with trade and protectionism, geopolitics

US President Joe Biden’s faltering performance at the 27 June presidential debate and subsequent gaffe at the North Atlantic Treaty Organization (NATO) Summit press conference stoked growing concerns among Democrats over his ability to beat Donald Trump at the polls. His subsequent decision to withdraw from the race and pass the torch to Vice President Kamala Harris left party supporters rushing to reset campaign strategy.

On the other side, the Republican camp overwhelmingly endorsed Trump as their presidential candidate.

With this in mind, a second term in the White House for the business mogul is a possibility, unless there is an upset and Harris manages to gain further ground.

There are numerous soundbites of Trump claiming that the US economy did better under his administration than Biden’s. We expect Trump will continue to be pro-growth, in line with the “Make America Great Again” (MAGA) slogan which has captivated swathes of the nation. Trump’s views on tax cuts and defence spending increases conveniently support the narrative, and if realised, the economy could be given a short-term shot in the arm. However, this will likely come at the cost of fiscal health as national debt and the budget deficit would soar to new heights.

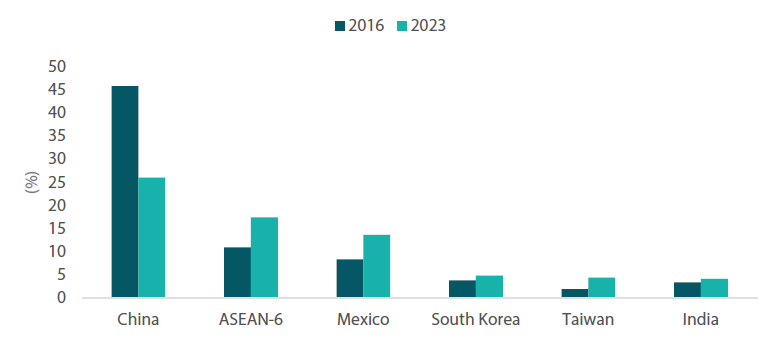

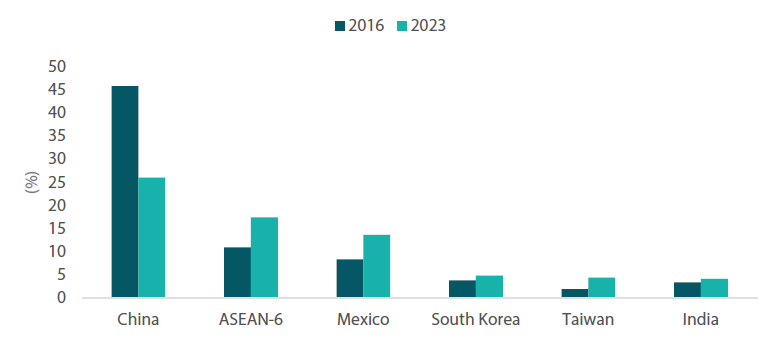

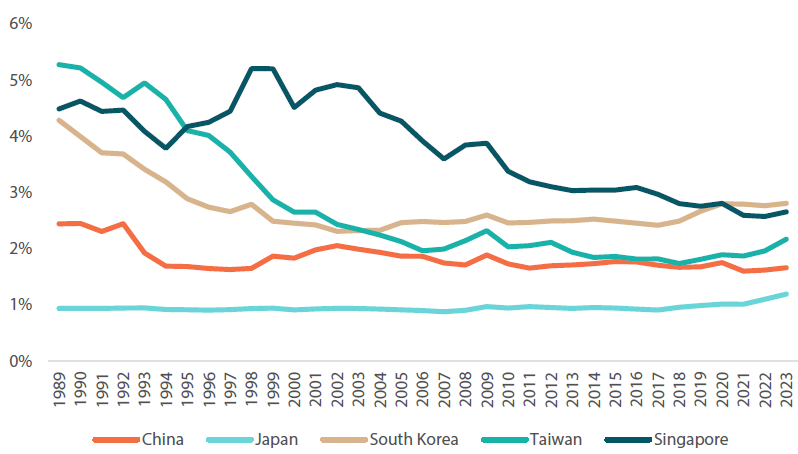

More protectionist measures against other countries and regions with prominent trade imbalances (e.g. China and the European Union) are a populist crowd pleaser for sure. But we view Trump as business-savvy enough to back down if there are lucrative deals to be made. Given the successive tariffs levied on a wide range of Chinese exports from the previous Trump era and by the current Biden administration, we believe equities in the world’s second largest economy have adequately priced in the risk associated with this scenario. However, some other Asian countries potentially in the crosshairs may have not. But does protectionism really work? One of the most important lessons from “Trump 1.0” was the ability of markets and companies to adapt to these changes. Although China’s share of US trade deficit decreased, this was almost completely offset by gains in other “friendlier” countries (Chart 1).

Chart 1 : US trade deficit with Asia and Mexico as percentage of total

Source: ITC, HSBC

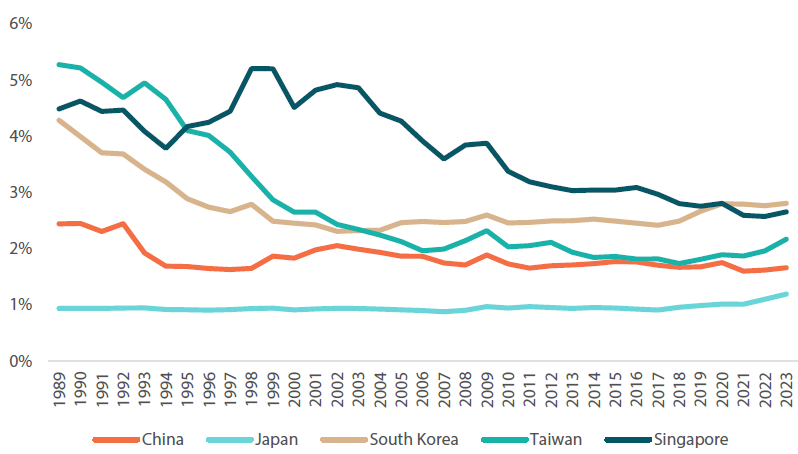

The geopolitical front could also experience further turbulence due to cross-strait tensions between Taiwan and Mainland China, a factor that markets have not yet fully priced in. Taiwan’s seemingly impenetrable “Silicon Shield”1, attributed to its global dominance in the chipmaking space, could see cracks. Trump has publicly expressed his desire to have Taiwan pay the US to defend it in the event of an invasion by an increasingly aggressive Mainland China. Chart 2 shows the defence spending by Asian economies as percentage of their respective Gross Domestic Products (GDPs).

Chart 2: Defence spending in Asia as percentage of GDP

Source: SIPRI

We can expect similar actions on the Russia-Ukraine war judging by Trump’s past demands for European NATO members to increase their share of military spending. This is already unfolding, as 23 of the 32 NATO members have agreed to spend at least 2% of their gross domestic product (GDP) to bolster their armed forces2.

Beyond trade, which sectors could be transformed under Trump 2.0?

Drilling deeper into fundamental changes for the renewables sector, Trump’s criticism of the Inflation Reduction Act (IRA) passed under the current Biden administration has raised concerns among makers of electric vehicles (EVs), batteries and their components, many of which are based in South Korea. Provisions giving Asian automakers more time to comply with geopolitical restrictions in sourcing EV battery materials under section 30D3 could be rolled back, creating undue pressure on their supply chains.

On the flip side of the scenario, oil and gas may experience an expansionary phase due to Trump’s “drill, baby, drill” approach as he is expected to scrap environmentally sustainable policies to boost production if elected. The resultant supply jump could lower prices, which could help tame inflation. However, it could be detrimental to corporations as profits might be squeezed in the near term. This perhaps represents the biggest divergence in policy between the Democrats, with their focus on net zero as represented by the IRA (first signed into law in 2022 and now moving from the planning to implementation stage) and the Republicans, with their “drill baby drill” approach.

In our view, healthcare could potentially benefit if Trump is re-elected. Although he vowed to cut drug prices during his first term, the close ties that Big Pharma cultivated within his administration effectively blocked any sector reforms, leading to price hikes instead. Catering more to his MAGA base’s anti-immigration stance could likely have knock-on effects on the sector, namely higher costs passed on to consumers which would further fuel inflation. Approximately 50% of new US jobs in the current fiscal year are estimated to have been filled by immigrants, with a significant portion of them in healthcare4.

The retail consumption sector is likely to keenly feel the threat of further tariff increases to offset perceived trade imbalances under a second Trump administration. This is because higher shipping costs will be passed on and crimp US household spending. A prime example is the scramble by Western retailers to frontload cargoes from China ahead of steep tariff hikes announced by the Biden administration in May this year on a range of Chinese imports. This resulted in ocean freight rates from China to Europe and the US hitting record highs the following month.

Further down the line, costs too will be incurred as retailers shift their supply chains to less-affected manufacturing bases. On the other end of the equation, Southeast Asian manufacturers, heavily dependent on Chinese industrial materials, could come under more scrutiny if their products are made with materials mainly sourced from China. We do, however, see muted impact on textiles given that the industry is well-diversified, with plants not only in China but also in Vietnam, Cambodia, Bangladesh and India.

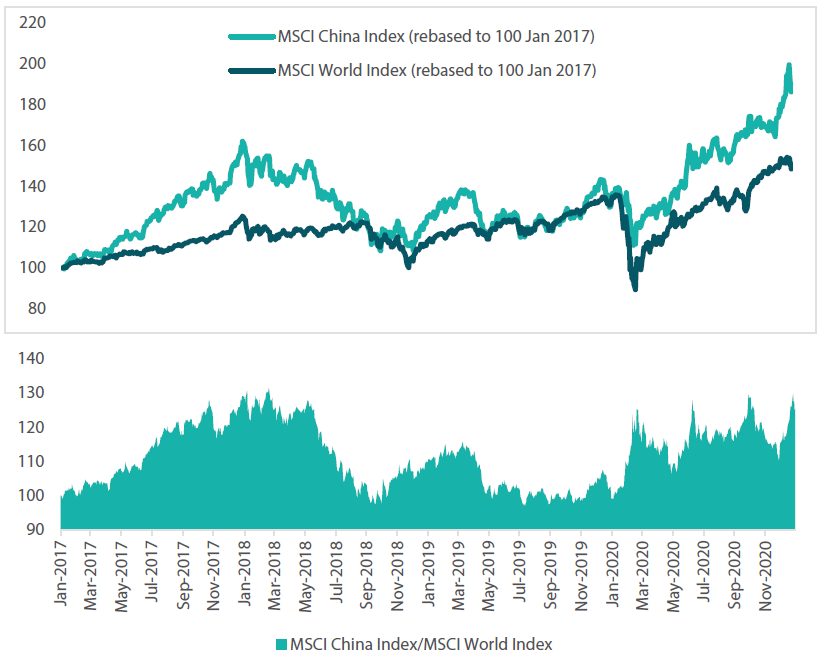

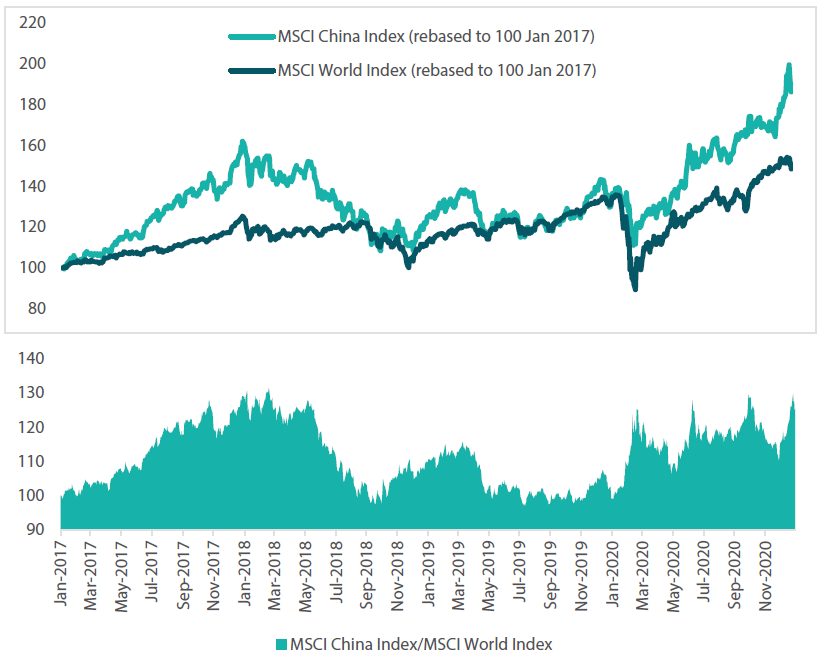

How a Trump 2.0 world is currently being envisioned illustrates how quickly the old economic order, which benefited immensely from globalisation and multilateralism, can be replaced by its opposites: protectionism and unilateralism. But it is not all doom and gloom. It is worth noting that Chinese equities delivered returns exceeding 85% during Trump’s first term, handily outperforming MSCI World by 25% (Chart 3). China’s trade balance with the US as a percentage of its GDP is low. While headlines focus on trade and Trump, it is domestic policy that matters more to most of Asia’s largest markets.

Chart 3: Performance comparison of MSCI China and MSCI World, Jan 2017–Jan 2021

Source: Bloomberg, 12 August 2024

In Asia, India could potentially benefit from changes

As we have seen markets and companies adapt, the biggest gainers during Trump 1.0 were parts of the Association of Southeast Asian Nations (ASEAN) and Mexico. If there is a Trump 2.0, India appears very well placed to harness potential changes. The country currently has a very small overall trade balance with the US, and it is therefore unlikely to become a target. Furthermore, India has made great strides in reforms and production-linked incentive programs and is being courted by both sides of the geopolitical divide. Singapore has been adept at managing the changing political landscape, maintaining its enviable status as a centre of finance and trade.

Up north, Mainland China is in the midst of transitioning from the world’s factory to a provider of high-value products and services, while South Korea and Taiwan are the backbone for technological innovation, providing essential components that power the global Artificial Intelligence (AI) revolution. We expect Asian equities to remain resilient for these reasons. At the end of the day, Asian equities could weather the various challenges presented no matter who wins the November US presidential elections.

Conclusion

Change brings both opportunities and risks. While we may not have an edge in predicting election results, we can at least be prepared for fundamental change and continue to evaluate individual companies on their ability to manage and adapt. At the time of publication, Trump and Harris were literally neck and neck at the polls, so a win by the latter cannot be ruled out. But should Trump triumph we would focus more on energy, healthcare, India and China’s domestic policy rather than the headlines.