Summary

- US Treasuries (USTs) came under significant selling pressure in October. The selling was driven by data underscoring US economic resilience, a more hawkish tone from several Federal Reserve (Fed) officials and speculation that Donald Trump would win the US presidential election. By the end of October, the benchmark 2-year and 10-year UST yields settled at 4.17% and 4.29%, respectively, 53 basis points (bps) and 50 bps higher compared to the end of September.

- Asian central banks took divergent paths on interest rates. The central banks of South Korea, Thailand and the Philippines lowered interest rates while their Indian and Indonesian counterparts stood pat on monetary policy. Inflationary pressures across the region mostly eased in October. The economies of China, Singapore and Malaysia registered another quarter of GDP growth.

- Given US fiscal deficit concerns and the potential for Washington increasing tariffs on its trade partners after Trump takes office, we consider it prudent to reduce overall duration risk in the near-term. Within Asia, we are more cautious on Thai rates, as we do not expect the Bank of Thailand (BOT) to ease policy further. Thai government bonds also appear particularly vulnerable to fluctuations in USTs.

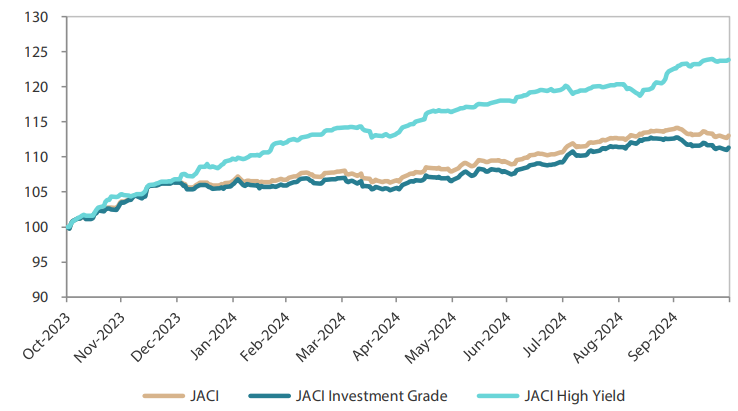

- Despite tightening credit spreads, Asian credits declined 0.99% in October amid a surge by UST yields. Asian investment-grade (IG) credit underperformed Asian high-yield (HY) again; Asian IG returned -1.34% despite spreads narrowing 19 bps. Asian HY credit gained 1.06%, with spreads tightening by 41 bps.

- The fundamentals backdrop for Asian credit remains supportive. Chinese authorities have finally unveiled a more substantial and coordinated policy stimulus package across the monetary, fiscal and property fronts. China’s initiative could at least provide some stabilisation in market sentiment. However, it remains to be seen if there will be a sustainable and meaningful impact on China’s property sector and broader real economy. Additionally, we expect macroeconomic and corporate credit fundamentals across Asia ex-China to stay resilient.

Asian rates and FX

Market review

USTs sell off in October

In October, USTs experienced a sharp sell-off, driven by data underscoring US economic resilience, a more hawkish tone from several Fed officials and speculation that former president Trump would win the US elections. US nonfarm payrolls increased by 254,000 in September, well above market expectations of 150,000, with upward revisions of 72,000 for the prior two months. The US core consumer price index (CPI) also exceeded expectations, indicating a pause in recent progress the US economy was seemingly making toward alleviating inflationary pressures.

The minutes of the September Federal Open Market Committee (FOMC) meeting revealed divided opinions regarding the size of the Fed’s interest rate cut. The Fed had lowered interest rates by 50 bps in September but the minutes showed that some officials were in favour of a more modest 25 bps reduction. Additionally, pre-election polls showing Trump with narrow leads in key swing states prompted another rise in UST yields, as markets foresaw potential inflationary pressures stemming from his proposed policy mix. By the end of October, the benchmark 2-year and 10-year UST yields settled at 4.17% and 4.29%, respectively, 53 bps and 50 bps higher compared to the end of September.

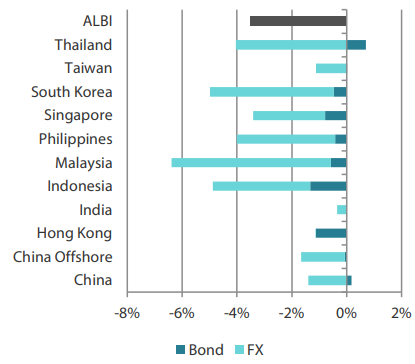

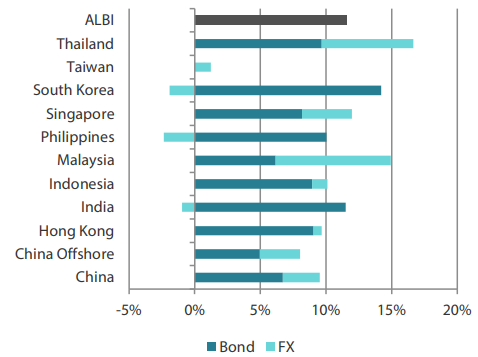

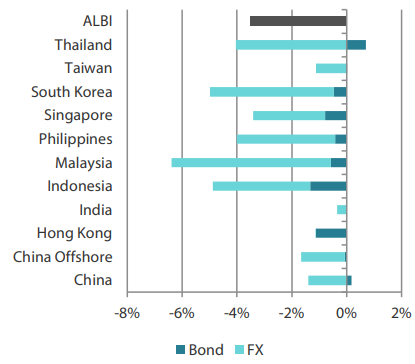

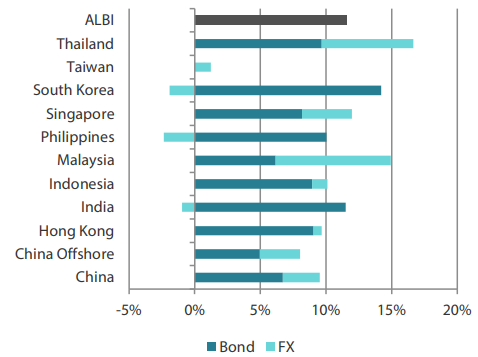

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 31 October 2024

For the year ending 31 October 2024

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 October 2024.

South Korea, Thailand and the Philippines lower policy rates

Central banks in the region took divergent monetary paths. The BOT, Bangko Sentral ng Pilipinas (BSP) and the Bank of Korea (BOK) each lowered policy rates by 25 bps. On the other hand, the Reserve Bank of India (RBI) and Bank Indonesia (BI) stood pat. The Monetary Authority of Singapore (MAS) kept its foreign exchange (FX) policy unchanged.

The BOT’s Monetary Policy Committee (MPC) voted 5-2 to reduce the one-day repurchase rate, with two members in favour of keeping the rate unchanged. BOT Governor Sethaput Suthiwartnarueput clarified that the rate cut should not be seen as the start of a prolonged easing cycle but rather as a “recalibration” of policy.

In the Philippines, the BSP continued easing, lowering its policy rate by 25 bps to 6.00%. The BSP also revised its 2024 risk-adjusted inflation forecast down to 3.1% year-on-year (YoY), from a previous estimate of 3.3%. BSP Governor Eli Remolona indicated that another 25-bps reduction could be possible in December, citing the revised inflation forecast.

In South Korea, BOK Governor Rhee Changyong noted that the decision to lower rates was not unanimous, with one board member opposing the easing. Additionally, he indicated that while further rate cuts are anticipated, they are unlikely in the near future.

While a number of its regional peers opted to ease monetary policy, Indonesia’s central bank kept its policy rate steady at 6%. BI Governor Perry Warjiyo emphasised that the central bank is focused on stabilising the Indonesian rupiah in the near term. However, he indicated that further rate cuts remain on the table, with the timing and extent of such cuts to be carefully assessed.

India’s central bank also left its policy rate unchanged but shifted its policy stance from “withdrawal of accommodation” to neutral, hinting at future monetary easing. RBI Governor Shaktikanta Das emphasised that the central bank remains firmly focused on aligning inflation with its target while also supporting economic growth.

In Singapore, the MAS kept the prevailing rate of appreciation of the Singapore dollar nominal effective exchange rate (SGDNEER) policy band, leaving unchanged the width and the level at which it is centred. The MAS also narrowed its 2024 core inflation forecast to an average range of 2.5% to 3%, down from the previous estimate of 2.5% to 3.5%. The MAS noted that the economy’s momentum has strengthened and is expected to continue expanding steadily, with growth projected to stay close to its potential in 2025.

Inflation continues cooling in September

Inflationary pressures across the region mostly cooled in September. Singapore’s September headline CPI moderated to 2.0% YoY, down from 2.2% in August. The moderation in Singapore’s headline CPI was due to a sharper decline in private transport costs, which more than offset the rise in core inflation.

In Indonesia, consumer prices rose at their slowest pace since November 2021, easing to 1.84% YoY, partly due to lower food and fuel prices. In the Philippines, the headline CPI increased by 1.9% YoY in September, the slowest increase since May 2020. This was largely due to a slowdown in both food and non-food inflation, bringing year-to-date inflation to an average 3.4%, comfortably within the government’s target range of 2–4%. Core inflation also eased to 2.4% YoY from 2.6% in August.

Malaysia saw its consumer price growth slow to 1.8% YoY in September, easing slightly from 1.9% in August. In contrast, Thailand experienced an uptick in inflation, with the headline CPI rising by 0.61% YoY in September, up from 0.35% in August. Thailand’s Commerce Ministry attributed the acceleration in the CPI to higher diesel and vegetable prices.

China, Singapore and Malaysia register third quarter growth

Chinese GDP growth slowed in the third quarter, expanding by 4.6% YoY, slightly below the 4.7% growth recorded in the second quarter. For the first nine months of 2024, the economy grew by 4.8% YoY, nearing the government’s full-year growth target of “around 5%”.

Meanwhile, according to advance estimates, Singapore’s economy grew by 4.1% YoY in the third quarter, an improvement from the 2.9% expansion in the previous quarter and surpassing expectations of a 3.8% increase. This acceleration was largely driven by strong performance in the manufacturing sector.

Similarly, Malaysia’s third quarter GDP growth also exceeded expectations, supported by robust growth in the services sector. The economy expanded by 5.3% YoY in the third quarter following a 5.9% increase in the second quarter.

Market outlook

Reducing overall duration risk in the near-term

Regarding the US market, the decisive Republican election victory has raised concerns about the state of the US fiscal deficit. Washington potentially increasing tariffs on imports from its trade partners is another worry. Given such concerns, we consider it prudent to reduce overall duration risk in the near-term.

Regionally, we have adopted a more cautious stance on Thai rates; we do not expect the BOT to ease policy further following its interest rate cut in October. Because Thai government bonds offer relatively low yields and have a historically high correlation to USTs, they appear particularly vulnerable to fluctuations in USTs.

Elsewhere, the reappointment of Sri Mulyani Indrawati as Indonesia’s finance minister provides a positive medium-term outlook for Indonesian government bonds, due to her strong track record on fiscal prudence. However, in the near term, we are maintaining our defensive view by taking a more cautious stance regarding duration exposure to Indonesian bonds.

Asian credits

Market review

Asian credits weighed by a sharp rise in UST yields

Despite tightening credit spreads, Asian credits declined 0.99% in October due to a surge by UST yields. Rising UST yields caused Asian IG credits to underperform Asian HY credits. IG credits fell 1.34% despite spreads narrowing by about 19 bps. Asian HY credits gained 1.06% as spreads narrowed by about 41 bps.

Asian credit spreads traded within a relatively tight range early in the month amid thin market liquidity, as China observed the National Day Golden Week holidays. However, the strong performance by Hong-Kong listed Chinese equities—boosted by Beijing’s stimulus measures announced in late September—drove a further tightening in Chinese credit spreads, especially among HY names. Subsequently, some of these gains were reversed in response to lacklustre announcements from Chinese policymakers. Notably, officials from the National Development and Reform Commission reiterated existing commitments but did not introduce new significant supportive measures. China’s Finance Minister Lan Fo’an announced several incremental fiscal stimulus measures. But the lack of details regarding the size of the fiscal package disappointed the markets. Investors are now hoping for details from the National People’s Congress Standing Committee in November.

Credit spreads subsequently narrowed again as investors took on more risk, attracted by higher all-in yields that had risen alongside UST yields. Sentiment around China also stabilised somewhat, helped by September activity data that hinted at economic stabilisation. China’s third-quarter growth slowed slightly to 4.6% YoY, while growth for the first nine months of 2024 reached 4.8% YoY. Towards the end of October, positive sentiment was reinforced by a rebound in home sales in major Chinese cities. By the end of the month, spreads for all major country segments tightened.

In frontier markets, Sri Lankan credits rallied on news of a government agreement with bondholders, while Mongolian credits surged as Standard & Poor’s upgraded Mongolia’s sovereign credit rating.

Primary market activity moderates in October

Following a hectic September, primary market supply eased in October, with total issuance moderating to USD 13.95 billion. The IG space saw 23 new issues amounting to USD 12.1 billion, including the USD 1.5 billion issue from Standard Chartered PLC, USD 1.0 billion issue from Korea Development Bank and USD 1.0 billion two-tranche issue from Citic Securities International. Meanwhile, the HY space saw five new issues totalling USD 1.85 billion.

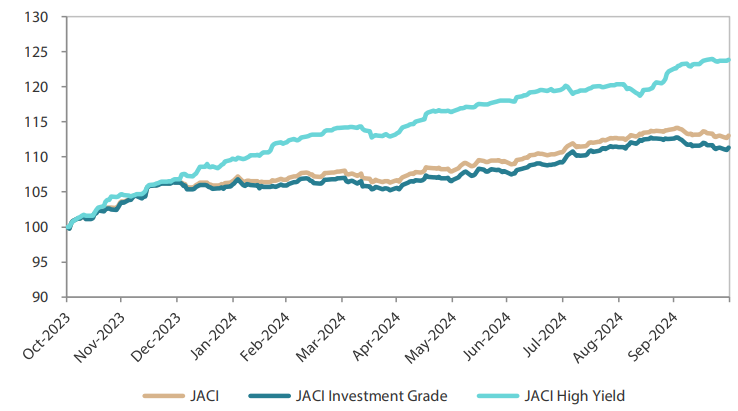

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 October 2023

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 October 2024

Market Outlook

Robust fundamentals and still strong supply-demand dynamics to support credit spreads

The fundamentals backdrop for Asian credit continues to be supportive. Chinese policymakers have finally unveiled a more substantive and coordinated policy stimulus package across monetary, fiscal and property fronts. We expect this policy package to at least provide some stabilisation in market sentiment. However, it remains to be seen if there will be sustainable and meaningful impact on the property sector and broader real economy.

Additionally, we expect macroeconomic and corporate credit fundamentals across Asia ex-China to stay resilient, albeit moderating from the strong levels seen in the first half of 2024 as the global economy potentially enters a temporary soft patch. The Fed’s easing cycle provides greater flexibility for Asian central banks to ease their own monetary policies, which should reinforce domestic demand. Apart from a few sectors, most Asian IG corporates and banks are seen entering this softer period with strong balance sheets and adequate ratings buffers.

These robust fundamentals, along with still strong supply-demand dynamics, may help contain any widening of spreads caused by an increase in risks. These risks include geopolitical and trade tensions, as well as concerns about the change in US administration. The biggest risk, in our view, to Asia’s macroeconomic and credit outlook is a deep US and global economic recession; however, this is not our base case. We still see any healthy correction as creating better entry opportunities for Asia credit, from the perspectives of both excess and total return.