Market review

Asian shares decline in October

Asian stock markets retreated in October after robust gains in the preceding month. Investors feared that the larger-than-anticipated rise in September’s US consumer prices could disrupt the Fed’s rate cut schedule. There was also caution ahead of the US presidential elections as polls indicated a close race between Donald Trump and Kamala Harris. These uncertainties led to a significant depreciation of most Asian currencies, resulting in a strengthening of the greenback. Asian markets lost steam amid disappointment that Beijing did not introduce additional comprehensive measures to arrest flagging growth following its stimulus blitz in September. The MSCI AC Asia Ex Japan Index declined 4.6% in USD terms for the month.

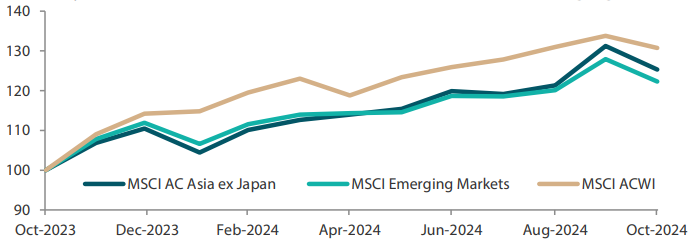

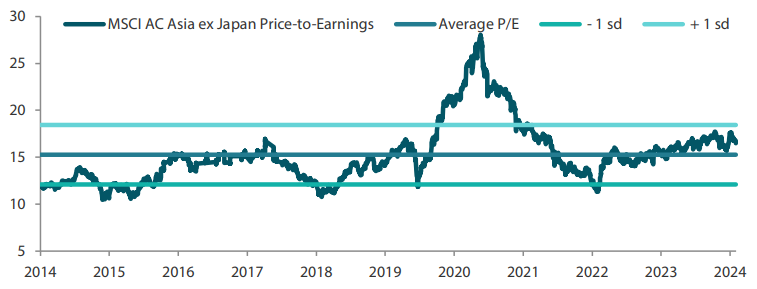

Chart 1: 1-yr market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

Rescaled to 100 on October 2023.

Source: Bloomberg, 31 October 2024. Returns are in USD. Past performance is not necessarily indicative of future performance.

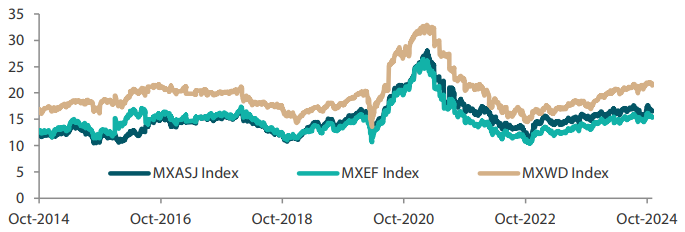

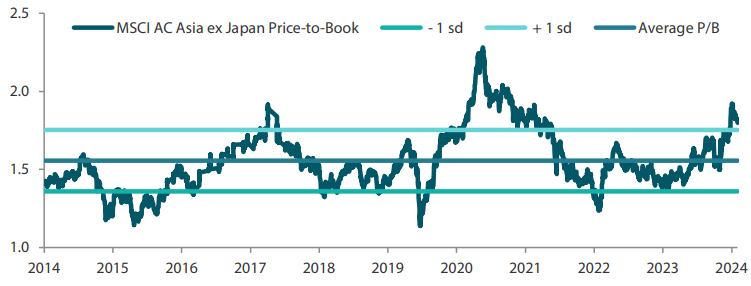

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 31 October 2024. Returns are in USD. Past performance is not necessarily indicative of future performance.

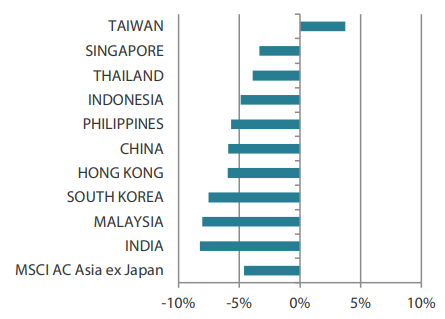

Taiwan outperforms in North Asia

In North Asia, the stock market rally in China (-5.9%) lost momentum due to a lack of stronger policy moves to bolster a sluggish economy. Chinese Finance Minister Lan Fo’an reiterated plans to jumpstart the economy, raise government debt and help consumers as well as the property sector. China’s third quarter gross domestic product (GDP) growth was the slowest in over a year as the property sector continued to weigh. Industrial profits in September also saw their sharpest drop in 2024 on tepid demand.

In Hong Kong, the territory’s Chief Executive John Lee has pledged to bolster the local economy and financial markets and also make housing more affordable. Lee intends to support his pledge with measures such as cutting liquor taxes, setting up a gold trading hub, streamlining regulations for stock exchange listings, relaxing mortgage loan-to-value ratios and making subsidised housing more accessible to the public. Despite Lee’s pledge, Hong Kong (-5.9%) followed Chinese shares lower in October.

In South Korea (-7.5%), exporters and consumer discretionary names led the market decline amid flagging global demand. To address growth concerns, the Bank of Korea lowered interest rates for the first time in two years as inflation remained stable. South Korea’s preliminary third-quarter GDP figures were weaker than forecast while factory activity shrank at its fastest pace in over a year in September because of tepid overseas demand. Taiwan’s share market was the sole bright spot in the region, rising 3.7%. The gains in Taiwan shares were led by technology components. Index heavyweight TSMC handily beat third-quarter earnings expectations on robust artificial intelligence (AI)-linked demand for its advanced chips.

ASEAN central banks take divergent steps

Turning to ASEAN, September non-oil domestic exports and preliminary industrial output in Singapore (-3.3%) grew at a slower pace amid geopolitical uncertainties. However, Singapore’s manufacturing activity was resilient thanks to a rebound in the electronics segment. Even with a promising budget, Malaysia’s stocks retreated 8.0% and gave back some year-to-date gains. The losses by Malaysian stocks were mainly due to a weakening ringgit, which fell 5.8% against the dollar. The Malaysian economy still remains resilient, with unemployment rates in September hitting four-year lows.

Thailand’s (-3.9%) central bank unexpectedly cut interest rates by 25 basis points (bps) to tackle slowing growth, with the easing received positively by local markets. In the Philippines (-5.7%), the central bank lowered interest rates by another 25 bps as inflation stayed benign. September consumer price index rose at its slowest pace in over four years due to lower transport costs and food prices.

In contrast to Thailand and the Philippines, Indonesia’s (-4.9%) central bank kept rates on hold after a 25-bps cut in September. However, this is unlikely not the end of its easing cycle given a higher frequency of policy meetings relative to other central banks.

Indian equities fall as company earnings and economic data disappoint

Indian shares (-8.3%) posted the biggest decline in the region in October. The decline was due to disappointing second-quarter corporate earnings and weaker-than-expected economic data. The Reserve Bank of India (RBI) kept policy rates on hold, noting that inflation in the country was abating. However, the RBI warned of upside risks such as unseasonal weather patterns affecting crops, global events and supply chain issues.

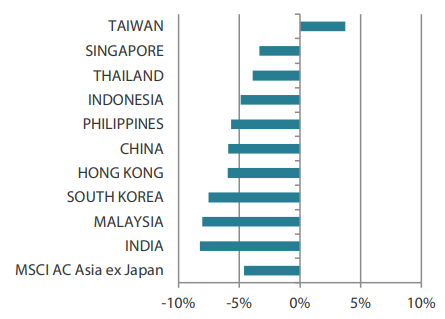

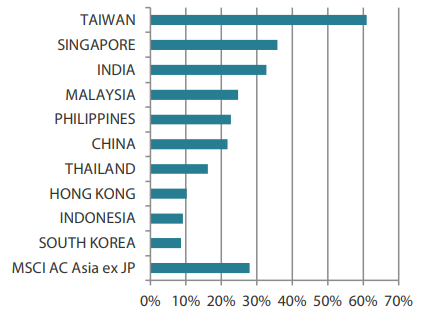

Chart 3: MSCI AC Asia ex Japan Index¹

For the month ending 31 October 2024

For the year ending 31 October 2024

Source: Bloomberg, 31 October 2024.

¹Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Staying focused on companies able to navigate and identify opportunities in a more fractious world

Headlines over the coming month are expected to be dominated by developments following the US election, which was one of the closest and most polarising race in recent history. Post-election developments could alter the course of the Fed’s fledging monetary easing cycle, trigger significant upheaval in energy markets and cause further dislocations in global trade and geopolitics. We did not predict the US election outcome and prepared for all eventualities. Our priority was to focus on companies and management teams with the best ability to navigate and find opportunities in an increasingly fractious world.

China's domestic policy and market environment to become significant factors during Trump 2.0

During the first Trump presidency from January 2017 to January 2021, China outperformed the S&P 500 index and all the perceived China Plus One beneficiaries of India, Mexico and ASEAN. While history may not be repeated, it is clear that China’s domestic policy and market environment will become significant factors during Trump’s second presidency. China remains reluctant to over-stimulate, seeking instead to stabilise the domestic economy and continue shifting away from property towards other growth contributors. If the export sector weakens further, we expect greater support for domestic consumption and services. We have found greater evidence of fundamental change in Hong Kong, where Chinese buyers are increasingly becoming a dominant force. This has directed our attention to more domestically-orientated companies in areas such as real estate and healthcare.

Retaining focus on quality franchises in Indian equities

India is one market that has been performing well for some time but it is possibly in need of a breather. This current Indian earnings season has shown little evidence of the expected improvement in rural and semi-urban consumption. Instead, long-established distribution networks and brand strongholds of several consumer companies may be under threat with stiff competition from new e-commerce and delivery companies. This, together with the RBI’s proactive approach to stemming both unsecured credit and non-banking financial company (NBFC) loan origination, is having knock-on impacts on end demand. We retain our focus on quality franchises in areas where we believe sustainable returns are undervalued and fundamental change is underway.

Preference for semiconductor and communications-related names in Taiwan and South Korea

Recently, there has been a significant divergence between the South Korean and Taiwanese markets. In South Korea, setbacks in the "Value-up” launch, cooling commodity dynamic random access memory (DRAM) prices and Samsung Electronics’ continued delays in high bandwidth memory are taking their toll. In contrast, Taiwan is benefitting from a strong drive in AI-related demand, as demonstrated by the earnings of companies like TSMC and several others. While the market continues to question the return on investment that tech-focused infrastructure rollouts may yield for the big spenders, the competition in this field shows no signs of abating. We remain selective, preferring semiconductor and communications-related names which have consistently shown their ability to shift towards new opportunities and that are better prepared for the changing geopolitical landscape.

In ASEAN, we previously discussed Malaysia as an emerging destination for investments. We expect this to continue as Malaysia reinvents itself as an alternative for technology production and a data centre provider. Malaysia’s recent budget was a nudge in the right direction and should bolster the country’s ability to attract foreign investment, though more efforts are needed. We have tempered our view of Indonesian equities for both stock specific reasons and to focus on incrementally more attractive opportunities elsewhere in ASEAN.

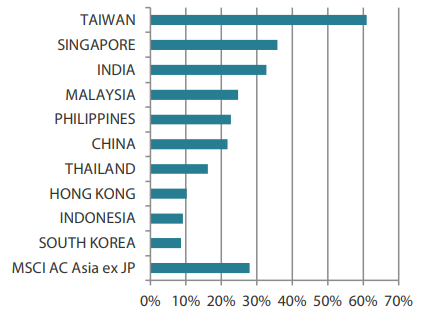

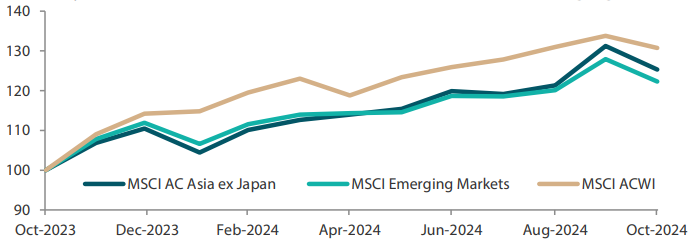

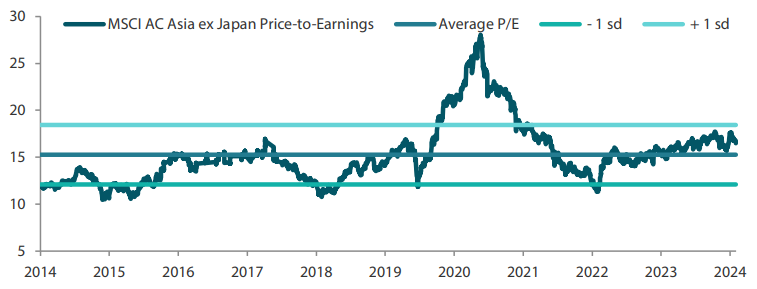

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 31 October 2024. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

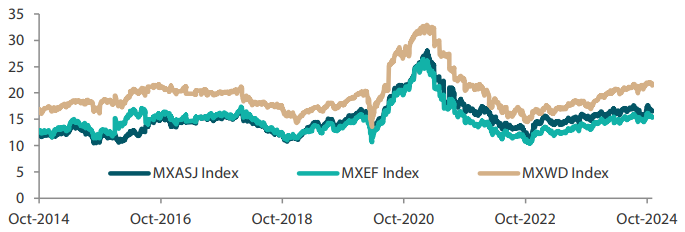

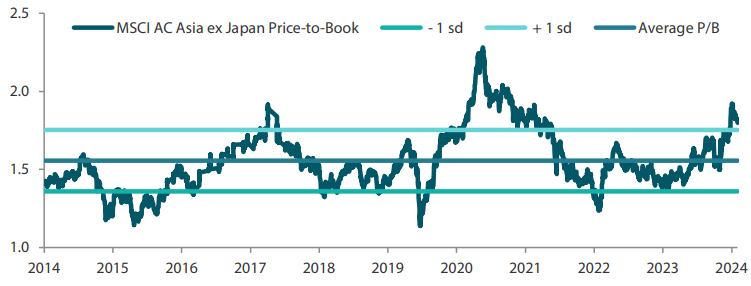

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 31 October 2024. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.