As the Global Investment Committee (GIC)1 convened on 26 September, our Q2 outlook for resilient though somewhat softer US growth had materialised. However, our US Earnings per share (EPS) growth estimates (consistent with robust but easing Gross Domestic Product (GDP) growth) remained slightly more conservative than market estimates. Going forward, we perceive heightened risk to both growth (two-way) and inflation (upside) compared to our Q2 guidance. Nevertheless, our central near-term scenario remains for slowing but positive growth in the US, alongside slowly moderating prices.

Key takeaways are as follows:

- We maintain our main view of benign growth in the US, accompanied by moderating inflation. However, we see heightened tail risks biased toward inflation for global markets and would look to diversify risk portfolios with assets resilient to inflation. We remain constructive on gold as a portfolio diversifier.

- We view Japanese equities favourably given comparatively reasonable valuations (vs. the S&P5002 or All Country World Index (ACWI)3) alongside multiple signals of Japan’s structural recovery. We would favour an increasing bias toward domestic demand-related stocks as these may be more resilient in the face of any correction in US markets.

- We see limited upside in long-duration US bonds, thanks to Federal Reserve (Fed) stimulus being amply priced in, and insufficient factoring of inflationary or fiscal risks into yields of longer-dated US Treasury bonds. Due to the positive correlation between US bonds and stocks, bonds no longer provide adequate diversification against downside risks. Moreover, a positive correlation persists among many global bond markets despite diverse interest rate trajectories. We view long-term bonds with caution.

Q3 2024 in review: the “great dispersion” in stocks and bonds

Over the course of Q3, the market experienced a change of course on several factors. Following a surprise rate hike from the Bank of Japan (BOJ) in July (the central bank took overnight rates to 25 bps), a downside surprise in US non-farm payroll data triggered speculation of imminent Fed rate cuts. This, in turn, led to the unwinding of speculative yen-funded “carry trades4”, triggering both a sudden drop in dollar-yen as well as unexpected volatility in Japanese equities—the target investments of short-term overseas investors utilising borrowed yen. Markets recovered quickly from the volatility, although dollar-yen appears to have corrected decisively lower from highs above 1605. Domestic investors went bargain hunting as Japanese indices sold off and listed Japanese corporates used their large cash balances to buy back their shares at lower prices. Underweight institutional investors accumulated domestic equities to rebalance their portfolios while households, unfazed by speculative selling, continued to buy exercising the tax advantages that accrued to them under the New Nippon Individual Savings Account (NISA)6. We convened an Extraordinary GIC at the time and shifted our guidance, primarily to allow for greater volatility. Aware that volatility tends to cluster and that markets may be at the threshold of a new volatility regime, we widened our ranges for both US Gross Domestic Product (GDP) and the Federal Open Market Committee (FOMC) to admit downside risks. We also implemented new ranges for valuation (Price/Earnings - P/E) alongside existing earnings ranges for Japanese indices.

Meanwhile, on the eve of the GIC on 26 September, markets had received news of surprise stimulus from China, on the heels of a larger-than-expected 50 bp rate cut from the FOMC on 19 September7 which had prompted bond markets to price in a succession of significant US rate cuts. Equity markets subsequently broke to new highs, even as bonds priced in a sombre macroeconomic scenario, though they barely reacted to the Fed’s move on 19 September as the market had already priced in multiple 50 bp interest rate cuts8.

Toward the end of Q3, both Japanese stock markets and dollar-yen were influenced by speculation that Japan’s ruling Liberal Democratic Party (LDP) would elect a new Abenomics-inspired leader (and thus prime minister). However, the LDP leadership vote on 27 September resulted in disappointment for the markets, which had to lower their expectations for the BOJ to end or indefinitely postpone its interest rate hike cycle. The LDP elected Shigeru Ishiba as its new leader and prime minister, who subsequently called a snap election for 27 October. However, as we noted in our insight, “Less may be more in Japan’s LDP leadership contest”, the situation is very different now than at the start of the Abenomics era when inflation struggled to turn positive. In Q3, we not only saw Japanese Q2 corporate earnings remain consistently strong but we also witnessed incipient signals of rising consumption demand, backed by the advent of positive year-on-year (YoY) real wage growth.

Global macro: growth risks persist, inflation tamer vs. Q2 on surface

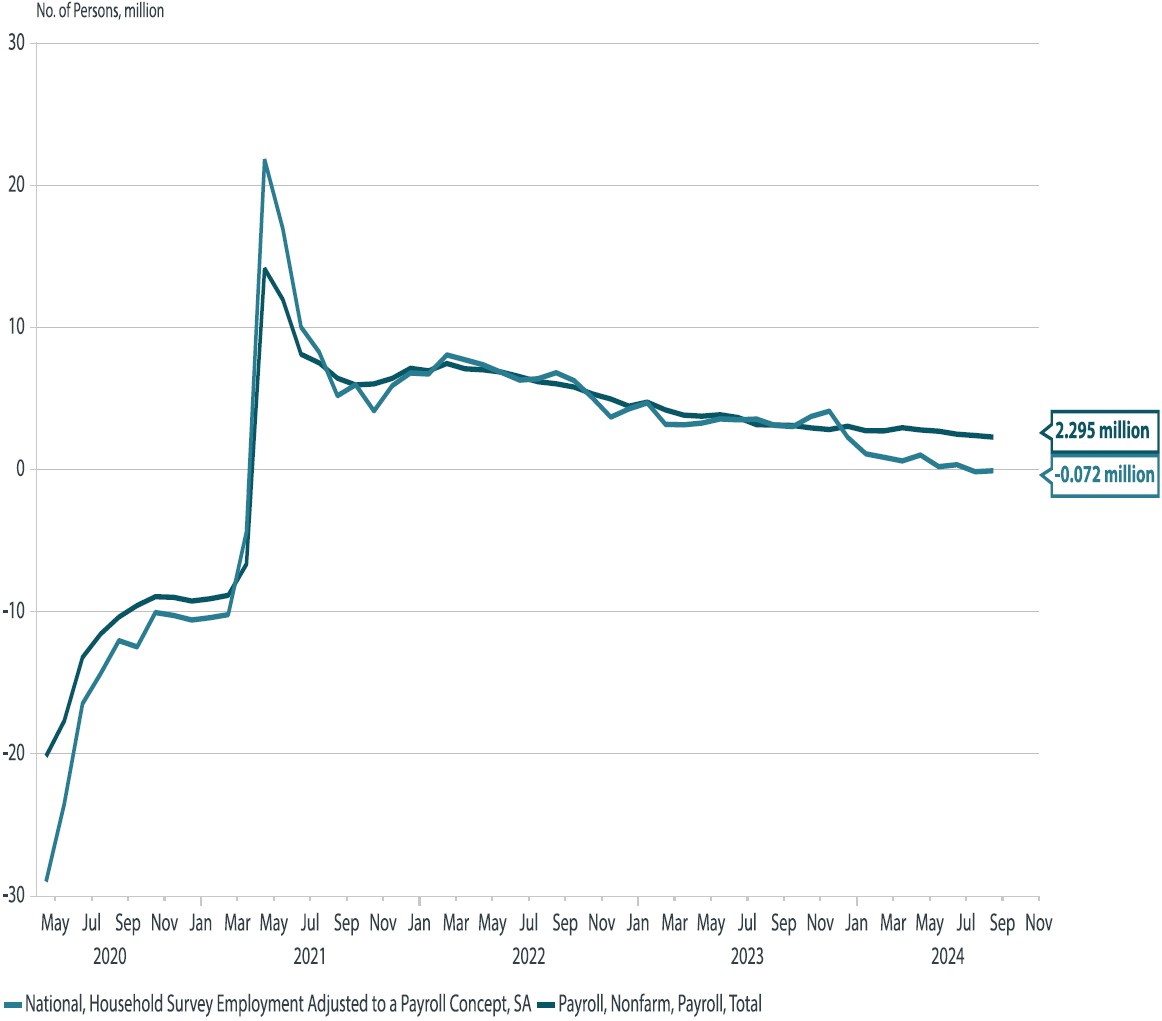

US: From a macroeconomic standpoint, there is not enough clear motivation from underlying economic indicators to price in an imminent US recession, even despite softening data. Although we foresee US GDP growth dipping below the 2% level, our outlook is for YoY growth to remain above 1.5% in the year to September 2025*. The US consumer has remained resilient, even despite a softer job market, with consumption among higher-income households assisted by the “wealth effect” of gains in US stocks. While much slower than in early 2024, the US continues to add over two million jobs to non-farm payrolls YoY9 (see “What the Fed’s rate cut tells us about current financial conditions”), which is stronger than job growth typically tends to be immediately prior to a US recession. That said, the unemployment rate has triggered the Sahm rule10 (typically a forward indicator of recession), due in part to the widening disparity between the household survey (which shows YoY job growth already in contraction), and based on which the unemployment rate is calculated and the establishment survey, which tabulates non-farm payrolls.

Chart 1: Employment conditions in the US

Source: Nikko AM, BLS, as of publication of the GIC Outlook (4 Oct 2024).?

Motivating the divide in part are disperse conditions between higher income households (where both job conditions and investment income are more supportive) and lower-income households, which comprise a higher proportion of the household survey than the establishment survey. Meanwhile, we see inflation as likely to ease gradually, although our median US core Personal Consumption Expenditure (PCE) outlook is for prices to show above 2% YoY growth over the course of the year to September 2025*. ,Our consensus forecast for both headline and US inflation sees inflation subsiding gradually compared to Q2. Notwithstanding, several members of our GIC cite heightened inflationary tail risks in light of possible unexpected events. Many of the risks highlighted have the potential to extend beyond the one-year outlook horizon.

Macro vs. forward-looking financial market indicators: We are carefully observing the “great dispersion” or reshuffling of scenarios priced into financial markets, particularly in equities and bonds. We are unconvinced that the circular logic of aggressively lower rates could justify ever-higher equity valuations. This is particularly so given the messaging from the Fed. Although the FOMC did comply with market expectations for a “jumbo” cut in July, Fed Chair Jerome Powell continues to warn against assuming this would be the “new pace” of monetary easing in the absence of clear deterioration of economic conditions. Meanwhile, should economic conditions deteriorate (which is the bond market’s signal) we are doubtful that the optimistic scenarios priced into the equity markets would indeed come to pass.

Japan: Despite financial volatility in August, Japanese GDP appears to be on course to continue growing above-trend (potential GDP has been estimated at around 0.6% by the BOJ). Nonetheless, our consensus view offer more conservative estimates of Japanese GDP growth than in Q2 (no longer above 2% YoY) thanks in part to slower—albeit positive—growth in the US and other export markets*. Meanwhile although headline CPI is foreseen dipping below 2% as early as the September quarter of 2025 with imported price inflation allayed by a slowly strengthening yen , our median GIC outlook is for ex-food inflation to remain above 2% over the year to September 2025*.

Euro area: We foresee Eurozone GDP growth as likely to break above 1% YoY and stay at these levels over the year to September 2025, although both headline and core inflation are likely to remain stubbornly in excess of the European Central Bank (ECB)’s 2% medium-term target*. However, immediate inflationary risks have been somewhat downgraded since the Q2 GIC, when we had pencilled in a higher level of upside risk for future European inflation in both headline and core Harmonized Index of Consumer Prices (HICP).

China: Were it not for China’s recent fiscal and monetary stimulus packages, we would have likely downgraded their GDP growth outlook, which is expected to still remain in the upper 4% range (but under 5%) over the year to September 2025*. According to our consensus view, compared to the beginning of Q3, when stimulus was not priced in, moves by the Fed and the People’s Bank of China (PBOC) have shifted the growth outlook. At the beginning of Q3, growth was seen to come from abroad while now there is much more focus on domestic recovery. Meanwhile, communication between the PBOC and the government, which had previously been much more compartmentalised, now demonstrates greater coordination and a tone of shared urgency among Chinese officials. Their aim extends beyond simply stemming the decline in the housing market, focusing instead on stimulating domestic demand growth.

We note that Chinese stimulus has been delivered at a time when markets are particularly sensitive to easing, though the size is half of what was delivered in 2009 (CNY 4 trillion vs. CNY 2 trillion in debt-funded fiscal easing in 2024) when the economy was one-third the size it is now. GDP growth may remain near the 4% level (compared to the 5% target), particularly in the near-term—specifically, in the fourth quarter of 2024 and the first quarter of 2025*. That the package also includes consumption coupons issued by an administration that once rejected what it deemed “welfarism” underscores the priority for China to keep social unrest at bay given its sluggish domestic economy. Nonetheless, our outlook for headline Consumer Price Index (CPI) remains at 1%, with core CPI still foreseen below 1% YoY over the year to September 2025*. This is because we perceive difficulties for China in lifting prices successfully; rather, attempts to date to boost the much greater consumer economy with investment in industry and export could potentially lower prices of exported Chinese goods. However, the impact of such pressures on trade partners could be limited in comparison to the early 2000s given today’s higher relative price levels, reduced global trade openness and rise in trade barriers. Additionally, though many Chinese firms do compete on price to gain market share, once gained, price increases often follow in an attempt to expand profitability.

Interest rates: the power of financial markets, a double-edged sword

FOMC: In line with our relatively softer growth and inflation guidance over the year to September 2025, we have also downgraded our FOMC outlook relative to Q2. As mentioned in the “macro” section, slowing indicators—particularly pertaining to US jobs—reinforce the need for further rate cuts. The more subdued economic performance is also apparent in the FOMC’s own downgraded “dot plots”11 for growth, inflation and rates. We took the Fed’s own forecast at face value to bring rates another 50 bp lower by the end of 2024*. This is less accommodative than the outlook currently priced into the bond market, which expects up to 75 bps in cuts by the end of 2024*. Subsequently, we foresee roughly 25 bps of easing per quarter, with a median interest rate outlook of 3.7%, between a 3.45% to 3.95% range, by the end of September 2025*.

BOJ overnight rates: In Q2, we had priced in a partial but not a full probability of a July rate hike, which we saw as a modest surprise. However, following our August review, we saw little risk of the BOJ following up its surprise July hike with immediate additional tightening measures before gauging the impact of its move in Q3. Moreover, the BOJ called out both financial markets volatility as well as uncertainty abroad (e.g. in US growth) as reasons to remain on hold in September. Much like the influence that the markets appear to have had on the Fed’s “pre-emptive” 50 bp cut, we see the BOJ’s stance as being much more conscious of market conditions than it was prior to the stock market volatility experienced in early August. We do foresee potential for another rate hike before year-end, but such a move would most likely come after the October inflation data is published. According to the media, consumers will face price hikes on 2,900 food and drink items in the month of October (the broadest price increase in 2024 so far)12, as firms pass along higher raw material costs to them. Our consensus forecasts are therefore pricing in prospects of another hike prior to year-end (with the median forecast at 0.3%)*. However, if financial market volatility arises again, the BOJ may remain on hold—all else being equal—at any point over the coming year. Conversely, if inflation unexpectedly rises, there is also the risk that the BOJ could deliver a larger rate hike; we expect a 25% or less chance that rates may rise to 0.45% before the year-end*. Subsequently, our consensus view foresee rates as likely to rise to 50 bp by June 2025, and to 75 bps by September 2025*.

European Central Bank (ECB): After our Q2 guidance of 3.65% for the September-end refinancing rate came in close to the actual outcome, we modestly downgraded our ECB outlook for the coming year. The Fed’s larger-than-expected rate cut in September may have opened the door for more aggressive easing by the ECB. Our consensus forecasts predict that it is somewhat likely for the ECB to reduce overnight rates before the year-end, and to a 3.075% to 3.575%* range by end of December 2025. Nonetheless, given persistent services inflation, especially in Europe, the rate cut outlook is more conservative compared to the FOMC. Our consensus foresee a further 75 bps of rate cuts as likely in 2025*. This compares to the FOMC’s 80 bps expected for 2025, in addition to the 50 bps of cuts in Q4 2024*.

10-year interest rates: The positive correlation between equities and 10-year bond prices mean that long-term bonds provide insufficient diversification from market risk., It is hard for bond market investors to “fight the Fed” given the significant influence financial markets have on policy. This may paradoxically dilute the power of financial market indicators, including US Treasury yield curves, as predictors of future economic activity. Moreover, the positive correlation in longer-term bond markets across global markets is also apparent, even despite differences in the timing of policy implementation. For example, in spite of improved prospects for near-term BOJ hikes since Q2 as factored into the short end of the Japanese government bonds (JGB) yield curve, yields on shorter-dated JGBs have decreased modestly since July, possibly influenced13 by the Fed’s interest rate reduction. Meanwhile, yields on long-term US Treasury bonds have declined even though the inversion14 between the 2- and 10-year benchmark Treasury yield has corrected. We foresee limited movement in 10-year Treasury yields from their current levels, even despite additional FOMC cuts, due to many of them already being priced into the bond yield curve*. Likewise, our central scenario is for little movement in 10-year Bunds15 over the coming year*. One significant caveatis that inflationary surprises and fiscal risk are of greater concern than in Q2. However, it is not a central scenario in our view that inflation will disrupt the Fed’s rate cut schedule.(see “Risks to Our Outlook* below).

Foreign exchange: gradual yen appreciation

Following volatility in August, we adjusted our outlook on the Japanese yen to allow for greater appreciation by the currency, as did the market as a whole. Partly responsible for this outlook adjustment was the prospect for narrowing yield differentials as the Fed eased interest rates and the BOJ tightened. Also, after observing one round of carry-trade unwinding and observing that market volatility tends to cluster, we upgraded the potential for volatile moves; volatility tends to come alongside yen appreciation. Meanwhile, the dollar’s prospects have been downgraded modestly across currencies. The downgrade is less pronounced against the euro, pound and Australian dollar compared to the yen. Noting that the September 2024 BOJ Tankan16 survey released on 1 October references a fiscal year-end dollar-yen rate of 144.31, which is reasonably close to the spot rate at the time of writing, additional appreciation may impact exporters’ overseas revenues, which we cover in the Japanese equities section.

Mild upside to commodities, dispersed view on gold and oil

In line with the downward adjustment in oil prices thanks to supply and demand factors, we downgraded Q2 assumptions on Brent crude, foreseeing oil to remain below USD 80 per barrel for the year to September 2025*. Any unexpected oil price gains, meanwhile, may result in an upgrade to inflation expectations. While this is not our central scenario, we do see rising risks connected to geopolitics, including violence in the Middle East. Our central scenario foresees mild upside to commodity prices over the coming year. Meanwhile, we expect the quest for diversification away from market risk, along with the inconvenient positive correlation between equities and US Treasuries (a traditional safe haven) will prove very supportive for gold in the coming year. Although the market prices a correction to near USD 2,500 per ounce over the next year17, we sees potential for gold to rise above USD 2,700, with a 25% chance of the precious metal climbing to USD 2,800 or higher over the year to September 2025*.

Earnings growth and equity valuation: making way for higher asset volatility

Over the immediate horizon, the Fed’s pre-emptive rate cut has had positive effects. Ongoing stimulus may continue to offer potential for resilient earnings growth from US stocks over the year to September 2025. We foresee double-digit Year On Year (YoY) earnings growth still remaining intact over the year to September 2025. However, we also flag risks associated with ongoing market concentration (see “Risks to Our Outlook” below). Although our earnings outlook remains roughly in line with market consensus, we foresee the potential for valuations to overshoot near-term due to Fed stimulus, and then gradually moderate over the course of the year to September 2025. We also anticipate potential for rebounds in lower-valued indices, such as the STOXX and Hang Seng. We believe that the latter can capitalise on its recent market trough as Chinese stimulus takes effect and earnings growth recovers. But we expect valuations to remain on a downtrend for the STOXX, while we see earnings recovering over the course of the year to September 2025*.

Japan equities: low valuation + earnings growth + volatility = opportunity

Although we foresee a rising trend in Japanese earnings and some adjustments in valuation over time, we expect volatility and dips in price to create significant opportunities for new purchases among longer-term investors.

Notwithstanding the volatility, we see potential for broad-based Japanese corporate earnings growth, plus significant ability for the index to regain ground after sharp dips. This is due not only to comparatively reasonable valuation relative to US stocks, whose Price/Earnings (P/E) ratios are well above their historical 20-year range, but also Japan’s strong structural growth backdrop. This is evidenced by the gathering momentum of domestic consumption and investment alongside improving governance among corporate firms. We also note the presence of structural buyers in the form of domestic companies buying back their own shares, financial institutions topping up domestic shareholdings to meet allocations and households exercising the tax advantages inherent in the new NISA.

However, we do not discount the potential for interim negative surprises, particularly among large exporters, given the smaller buffer that current yen rates provide to exporters in terms of overseas revenues and investment income windfalls.

Broader price ranges reflecting reactions to earnings surprises and valuation shifts: In August, we had introduced ranges not only for EPS growth but also for P/E ratios. We calculate price ranges taking into account the combined maximum and minimum impacts of earnings growth and valuation shifts. The highs within the price range represent our anticipated upper end of index fluctuations due both to earnings surprises and valuations, which we believe will experience bouts of interim volatility so long as market trading remains dominated by foreign investors (who on aggregate trade more frequently than domestic investors) even though many classes of domestic investors are likelier to buy and hold.

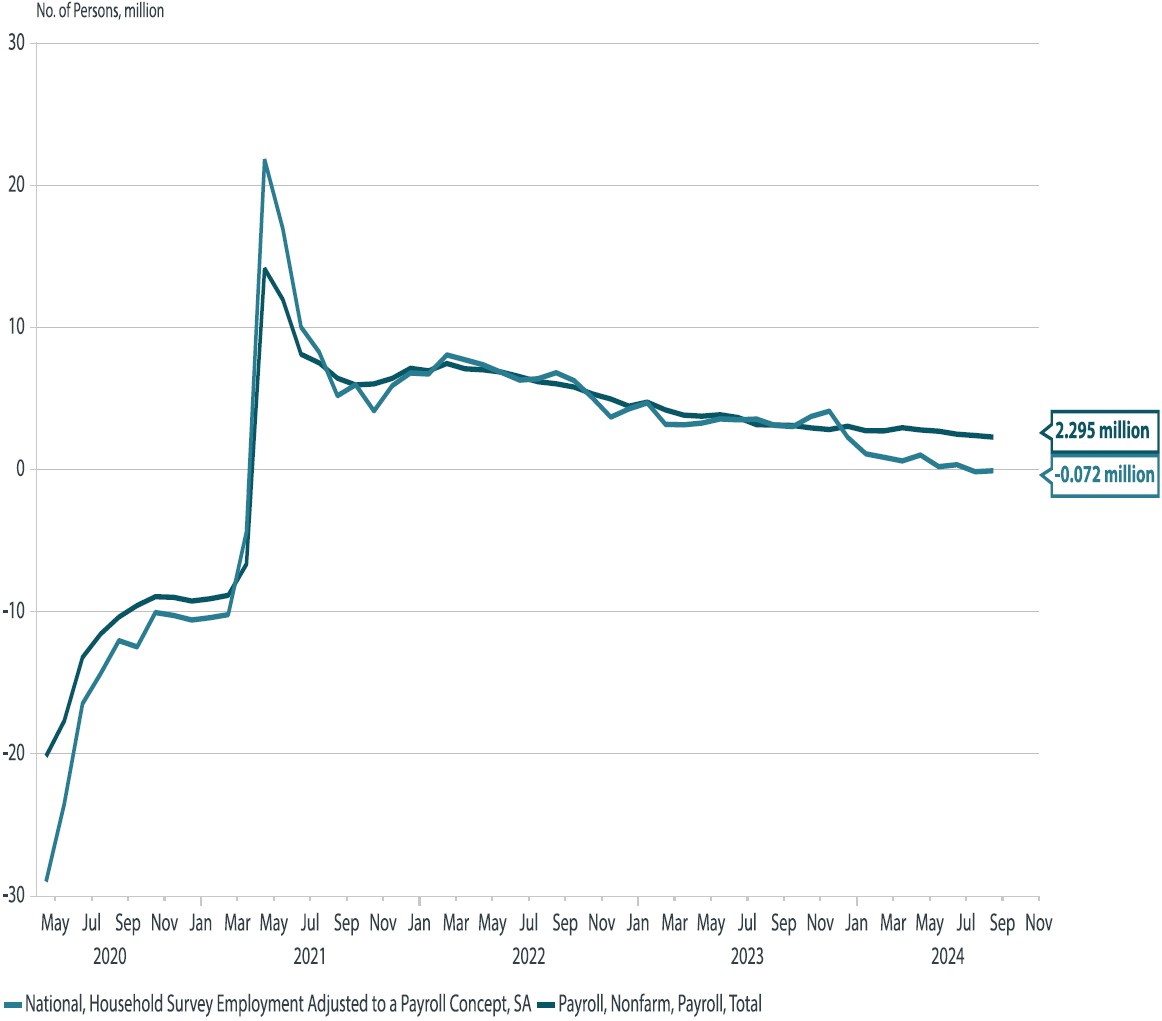

Chart 2: Percentage of total Tokyo Stock Exchange (TSE) trading volume by foreigners

Source: Nikko AM, Tokyo Stock Exchange (TSE), date?

Risks to our outlook: harbingers of inflation

Despite the generally benign outlook to global growth and inflation, members of our GIC cited the following heightened risks that could lead to further inflationary upside:

- Inflationary outcomes from US elections: almost every GIC member cited risks related to and following US elections, along with risks associated with increased inflation. Members generally assigned a higher probability to this risk than in the June GIC, with aa15-30% probability of inflationary policies such as trade tariffs and stricter immigration regulations*. US immigration, incidentally, has been recognised in recent statements by the FOMC to broadly dampen the impact of cost-push wage inflation18. Another inflationary risk cited was that of unsustainable fiscal expenditures, which could impact the longer end19 of the US interest rate curve. One GIC member pointed out that an outcome where both the Executive and Legislative branches were aligned (though lower in probability than a mixed result) would be more likely to lead to unsustainable fiscal expenditure, which might be received positively by markets on impact and offer an anticipatory boost. At the same time, this outcome might also heighten the risks further along the line of dislocation in bond markets, should overseas investors, who finance the US current account deficit, perceive long-end US yields as an insufficient premium to cover the forward-looking risks inherent in rising debt-to-GDP ratios of above 120%*.

- Political violence and geopolitical risk: Escalating political violence not only between Israel and Palestine but now also involving Lebanon, as well the ongoing Russia-Ukraine war, have prompted us to upgrade geopolitics as a source of risk, potentially also contributing to inflation. Although our main scenario is for oil prices to remain subdued below USD 80, this could change if political violence spurs fears of supply risks. Our consensus forecasters have assigned around a 20% probability to a middle to high impact outcome where political violence escalates and gives rise to disruptive inflationary pressures*.

- Two-sided risks for AI earnings and concentration in technology: Several GIC members cited the potential for risks surrounding the concentration of US equity returns in technology, and specifically in AI-related stocks. The highest probability risks (rated middle impact) were assigned 25% and involved the risk of investors becoming impatient and downgrading technology due to the low current return on investment (ROI) on AI-related capex, and therefore imposing a valuation downgrade despite positive current earnings. There is a 15% probability for risks surrounding anti-trust cases against large technology firms, as well as potential for re-rating of revenue expectations among tech firms. One of our GIC members also cited a high risk of 40% probability that negative operating leverage20 for companies not exposed to AI, coupled with diminishing pricing power and an inability to compete on price, as well as rising input costs (including labour) has the potential to undermine earnings in sectors other than tech. This would increase the US markets’ already high reliance on the sector to generate earnings growth. On the upside, another of our GIC members noted with an 18% probability that already implemented investment in AI, alongside aggressive easing from the Fed, could provide the US with a long-awaited productivity boost. This could lead to an upgrade to non-tech sector valuations, which have been lagging to date*.

- Self-referential US market rally reverses, negatively impacting real growth: The risks associated with any broader unwinding positions in the US tech sector are likely to be more significant than those associated with the unwinding of the Japanese “carry trade”. In Japan, the base of buyers to date has been narrow (and structural buyers are not yet overweight); Japanese households’ exposure to equities is below 15% of their balance sheet, while their cash holdings total over 50%21. Conversely, in the US, households’ exposure to equities and mutual funds is above 40%22. This means that potential for a large market correction to impact real US GDP is greater. To date, the “wealth effect” appears to have supported US consumption above and beyond employment income growth. In the event of a major US market downturn, we estimate a 20% probability o that the wealth effect will have a negative impact upon US consumption*.

Investment strategy conclusion: stay invested, insure against inflation

Our anticipated economic outlook remains benign. Although we anticipate a slowdown in US growth, we do not foresee recession as imminent, with the Fed’s pre-emptive rate cut already contributing to accommodative financial conditions due to its anticipatory impact on financial markets. Accommodative financial conditions remain supportive near-term. Meanwhile, though it remains difficult to anticipate the timing of market-related corrections, we also signal heightened tail risks associated with policy uncertainty surrounding elections in the US as well as the potential for even small disappointments in economic data and policy to have a greater impact on asset markets and therefore growth in the future. We see the risks as biased toward the inflationary, and also foresee the disparity in outlooks priced in by the US bond and stock markets as ultimately unsustainable. In the event of upside risks to inflation, holding stocks (however volatile) may help protect the future purchasing power of investors, while upside may be limited for bonds, even if central banks do deliver easing as anticipated. For this reason, we continue to see demand for assets that are typically resilient to inflation that may also provide diversification hedges against US market risk. We favour gold and increasing exposure to Japanese domestic demand, which is showing signs of sustainable structural recovery and is less correlated with US growth and stimulus than export-oriented firms*.