India on the rise

It has been a momentous year so far for India. In March, the country celebrated the triumph of winning two Oscars at the 95th Academy Awards for best original song (from Indian action movie RRR) and best documentary short film (The Elephant Whisperers). A month later, the United Nations declared that India had overtaken China as the world's most populous country. More recently in August, India once again made history after becoming the first nation to land a spacecraft near the moon’s frosty south pole.

India is also primed to be the world’s fastest growing big economy in 2023, according to the International Monetary Fund, which recently bumped up the country’s growth forecast for financial year 2024 to 6.1%1, citing strong domestic investment. That is why it is no surprise that the Indian stock market is one of the better performers in Asia this year2 with investors continuing to re-rate the growth potential of the Indian economy.

Driven by a combination of favourable government policies, strong investment inflows and structural reforms, India could continue to enjoy a period of sustained economic growth and development, in our view. As we see it, the nation's recent economic success is a testament to its resilience and ability to adapt to changing global economic conditions. From promoting domestic manufacturing, endorsing renewable energy and reducing carbon emissions to upgrading its infrastructure and furthering access to education and healthcare, India is taking steps to tackle some of the biggest challenges facing the world today.

We have identified several key transformational trends that could propel the next phase of growth for the Asian nation. These include more targeted structural reforms, dedicated investments in energy transition, rising consumption and further improvement in the country’s infrastructure, productivity and manufacturing sector.

Continuous reforms

India’s economy was liberalised through a series of reforms starting in 1991. The Indian government, under Prime Minister Narendra Modi, has stuck to the reform path since 2014, focusing on transparency, effective spending of public monies and lowering corruption. In addition, the Modi administration has been focusing on improving the ease of doing business in the country and has put in place systems and processes to alleviate red tape in areas including business and property registrations, construction permits, electricity procurement, securing credit and trading across borders.

India has been known for its arduous bureaucracy and red tape. For instance, to build a residential building in Mumbai, a company would require around 58 regulatory approvals before it could start to lay a brick. There were also similar bureaucratic hassles and complicated administrative/regulatory procedures when registering businesses, setting up factories or procuring electricity. In recent years, however, there has been an improvement in the ease of doing business in the country. With administrative reforms, setting up a new factory in India can be done via a one-click, seamless process, given the right paperwork, as compared to a long-drawn procedure that could take 12 to 18 months previously.

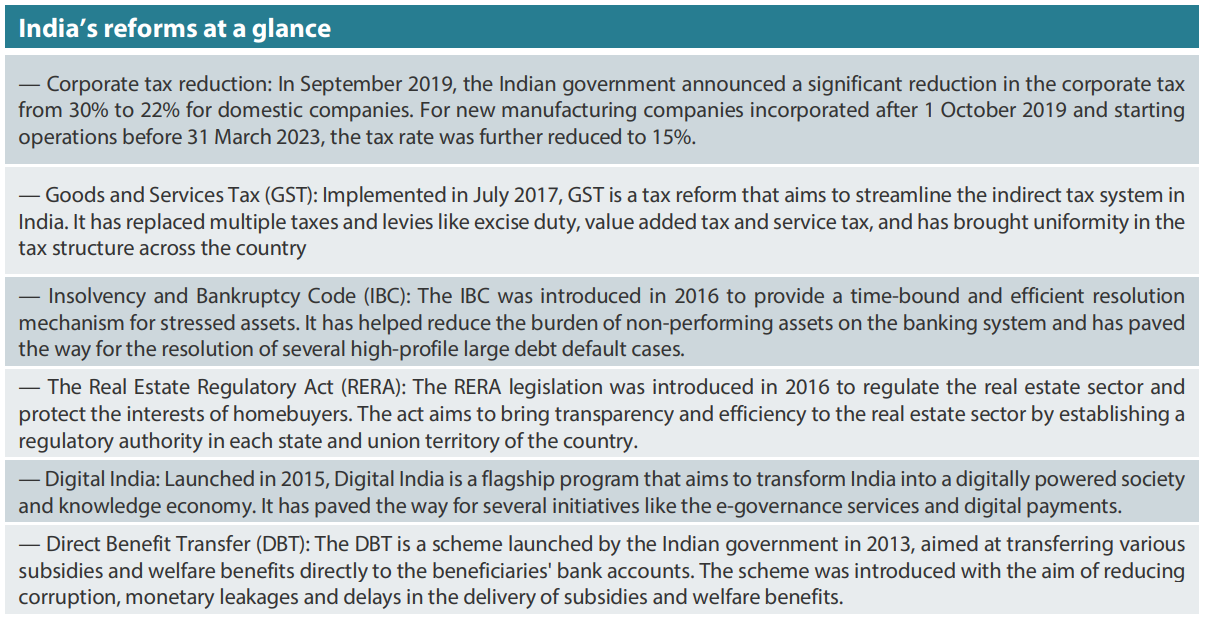

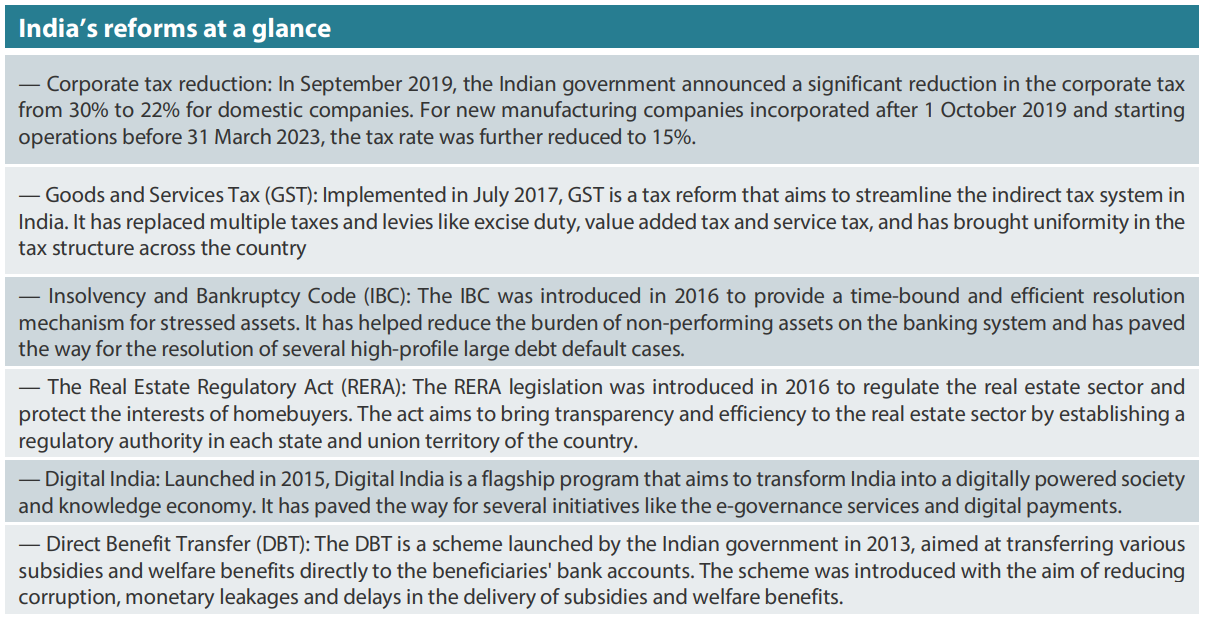

Some of the key reforms introduced in the last few years include the implementation of Digital India, Direct Benefit Transfers, Goods and Service Tax, Insolvency and Bankruptcy Code, Real Estate Regulatory Act and corporate tax reduction (see Table 1 for more information about these reforms).

Table 1: India’s key reforms in recent years

The Indian government is likely to introduce more reforms in the future to address the challenges and opportunities faced by the country, in our view. We believe that future reform measures will be aimed at promoting economic growth, boosting investment and improving the ease of doing business in areas such as infrastructure development, healthcare, education, agriculture and technology. We have long held a favourable view of high-quality financials and real estate developers, which are the best ways to play reforms in India, in our view.

Investment in energy transition

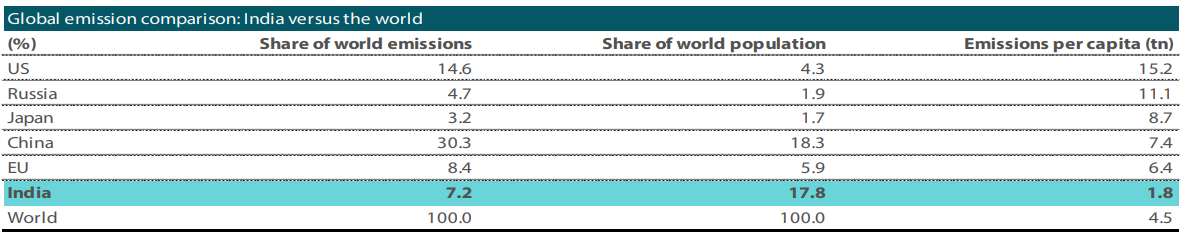

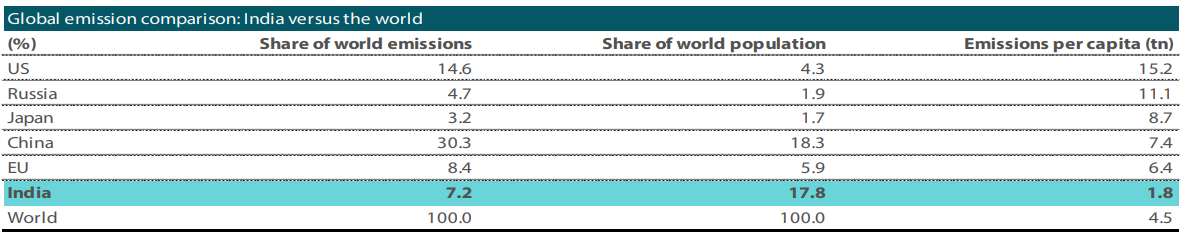

As a large country with vast land mass and an agrarian economy, India is generally prone to the negative impacts of global warming and erratic weather patterns. The country also suffers from a high level of pollution and is home to many of the most polluted cities in the world. India’s per capita emissions are low but the nation’s emissions are high in absolute terms (see Table 2). Hence, focusing on a greener future is a step in the right direction.

Table 2: India’s per capita emission is low, but its share of world emissions is large

Source: World Bank (2018), CLSA, September 2022

India is increasingly moving away from traditional energy sources (namely fossil fuels such as oil, gas and coal) towards greener power. In the last five years, India has set up roughly 60 gigawatts (GW) of renewable energy capacity, and renewables now account for 25% of the country’s energy power capacity compared to less than 14% earlier3. More importantly, it has set an ambitious target to grow renewable capacity to 450 GW by 2030 as compared to about 100 GW currently3. Also, India has committed to cutting its emissions intensity by 33–35% from 2005 levels by 20303.

The Indian government has launched the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, which provides incentives for the purchase of electric vehicles (EVs) and the establishment of charging infrastructure. Furthermore, India is promoting the adoption of smart grid technologies, improving the quality of power supply and reducing transmission and distribution losses. Overall, India's energy transition initiatives are aimed at reducing the country's dependence on fossil fuels, promoting sustainable development and meeting its commitment to the Paris Agreement on climate change.

As the world becomes greener, we expect massive opportunities for investments in energy transition in India. These will be in renewable power, electric charging points, roof top solar, EVs, electric batteries and storage. We currently favour Indian autos, energy and industrial sub-sectors related to this theme.

The rise of the Indian consumers

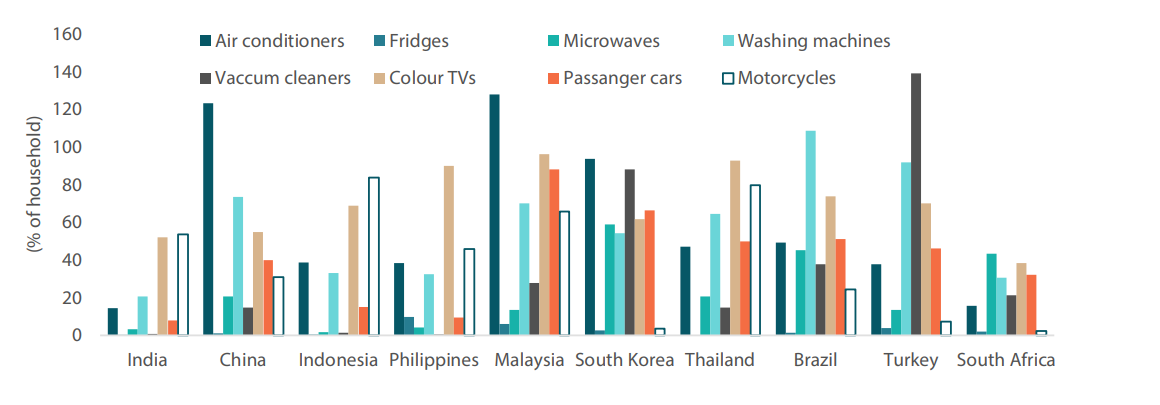

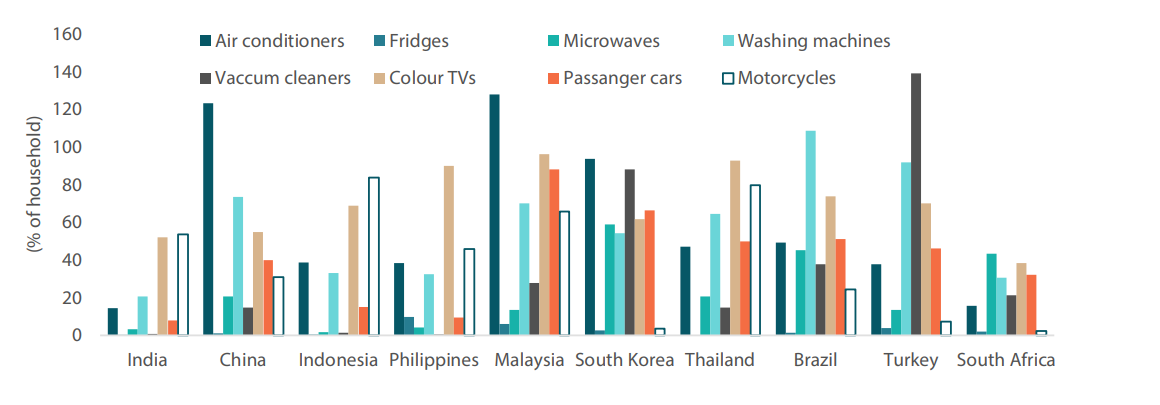

India has a population of more than 1.4 billion4, which comprises a large young section with rising income levels that will drive consumer spending in the near future. Today, the per capita for various good and services in India remains low even when compared to other developing economies (see Chart 1). As Indians become richer, their aspirations will also grow, and this will lead to increased demand for various good and services. That is why one of the key trends we are focused on is the rise of the Indian consumers.

Chart 1: India’s per-capita consumption is among the lowest in the world

Source: Euromonitor, CLSA, September 2022

From a medium-term perspective, we believe various consumer segments in India will create substantial alpha (or excess returns) for investors. There are many examples of sections with potential in the consumer segments and we believe large, long-term opportunities exist in various under-penetrated categories. We also believe that premiumisation will remain a trend with the Indian consumer. As such, organisations which focus on offering value to consumers’ needs may benefit substantially.

Infrastructure and productivity development

Another important trend in India is infrastructure and productivity development. Over the last few years, India’s roads, ports, airports, hospitals and schools have seen massive investments as the country has made a concerted effort to improve its infrastructure. For example, the government has launched several initiatives, including the Bharatmala Pariyojana, Sagarmala Project, Smart Cities Mission, and the Atal Mission for Rejuvenation and Urban Transformation (AMRUT).

The Bharatmala Pariyojana is a road development program that aims to build over 66,000 kilometres of highways and create a network of economic corridors across the country, while the Sagarmala Project aims to modernise India's ports and create a network of logistics hubs to promote trade and commerce. The Smart Cities Mission aims to develop 100 smart cities in India, using technology and data to improve the quality of life for citizens. In addition to these initiatives, the government has also taken steps to improve the country's aviation and railway infrastructure. To promote regional air connectivity, it has provided financial incentives to airlines to operate flights to underserved airports. Likewise, the Indian government has rolled out several railway projects, including the Dedicated Freight Corridor and the High-Speed Rail Project.

Despite the improvement, infrastructure standards in India continue to remain vastly below global averages. As India continues to grow, there will be a constant need to develop and improve the quality of infrastructure. The Indian government has been allocating significant amount of funds towards infrastructure development, which is seen as a key driver of economic growth and job creation. This trend is likely to continue, in our view.

Improvement in productivity through higher education is also expected to be another focus area for the Indian government. India has a large middle-class population, and increasingly, many families are determined to provide an all-round education for their children. Also, the Indian government continues to focus on enrolling the poorest of the poor into schools. Overall, education levels in India continue to rise, and in some states, such as Kerala, 100% literacy has been achieved.

Alongside the rise of productivity and education, what has changed fundamentally in India in recent years is the greater access to basic necessities like electricity, drinking water and liquified petroleum gas (LPG) for cooking. Every village in India now has access to electricity, and an estimated 60% of Indian rural households now have tap water connections with access to drinking water (according to the Ministry of Jal Shakti [water resources])5. Likewise, the share of Indian households using LPG as the primary cooking fuel had risen to 71% in 2020 from 33% in 2011, according to the India Residential Energy Consumption Survey (IRES) conducted by the Council on Energy, Environment and Water in October 2020.

Greater access to basic necessities are expected to help increase the participation of women in the Indian workforce and lead to higher economic growth. Likewise, improving basic infrastructure and higher education levels is seen having far reaching implications, which we expect will enable India’s economy to grow at a high and sustainable rate for years to come. We believe these fundamental changes can be tracked through hospitals, microfinance companies and web-based insurance distributors.

Enhancing India’s manufacturing capability

The world has been through significant fundamental changes in recent years. COVID-19 disruptions and increasing geopolitical tensions have forced global companies to look to strengthen the security and diversification of their supply chains. Given India’s large labour force and its improving infrastructure, we believe India can be the alternative factory of the world, alongside China.

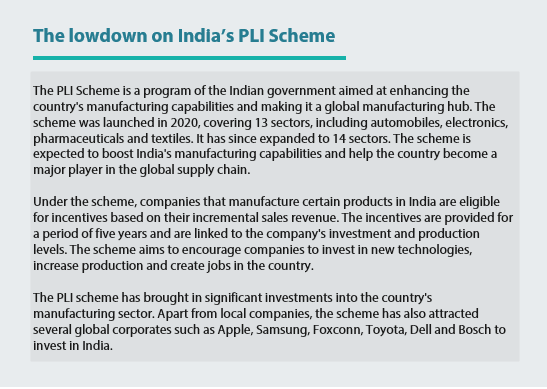

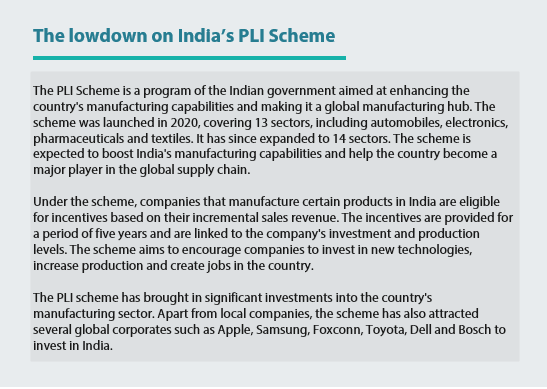

Apart from improved ease of doing business and lower corporate tax rates, the Production Linked Incentives (PLI) Scheme, which was established in March 2020, is boosting India’s manufacturing ambition (see the box below for more information about the PLI Scheme). Currently, manufacturing makes up just over 15%5 of India’s GDP; the share has been stagnant for over 10 years. Also, India’s share of global manufacturing is just 3-4%, versus China at over 30%6. We expect India’s manufacturing sector to grow significantly over the coming decade.

Mobile phone production in India is one of the success stories of the PLI scheme, helping the country’s net exports of mobile handset to rise manifold in recent years. Today, India is the second largest mobile handset manufacturing nation in terms of volumes7.

Risks and ESG considerations

While we see many long-term opportunities from India’s transformational trends, there are risks that could potentially delay, alter or even derail the outcomes of the country’s developmental plans. Deep-rooted structural reforms, for instance, will have to continue in order to unlock the massive demographic and economic potential of the country, and any inertia or stoppage in reforms could potentially throw a spanner in the economic engine.

Furthermore, like many other emerging countries, India faces numerous environmental, social, and governance (ESG) risks that can impact its economy, society and environment. Some of the key ESG risks faced by India include:

— Climate change: India is one of the countries most vulnerable to climate change, with rising temperatures, water scarcity, and extreme weather events posing significant risks to the country's agriculture, infrastructure and public health.

— Pollution: India has some of the world's highest levels of air pollution, which can have significant impacts on public health and the environment. Notwithstanding its energy transition initiatives, the country's large population, rapid urbanisation and industrial growth could exacerbate the country’s pollution problem.

— Labour rights: India is facing significant challenges related to labour rights, including issues related to child labour, forced labour and poor working conditions in certain industries.

— Corruption: Bribery and fraud remain significant challenges in India, with still high levels of corruption in government, public institutions and the private sector.

That is why it is crucial, in our opinion, to incorporate and integrate ESG analysis (including ESG risk and return factors) into the investment process when investing in India. As bottom-up, fundamental stock pickers who focus on undervalued stocks investments that are benefiting from fundamental changes and capable of delivering sustainable returns, we also believe that strong and improving ESG fundamentals are essential for achieving sustainable higher returns. ESG factors take precedence and act as red flags to all our investments in India, which in our view, is heading in the right direction as far as ESG is concerned.

Overall, we remain structurally positive on India as it offers high sustainable growth and is undergoing significant fundamental changes driven by reforms, energy transition, rising consumption and other long-term transformational trends.